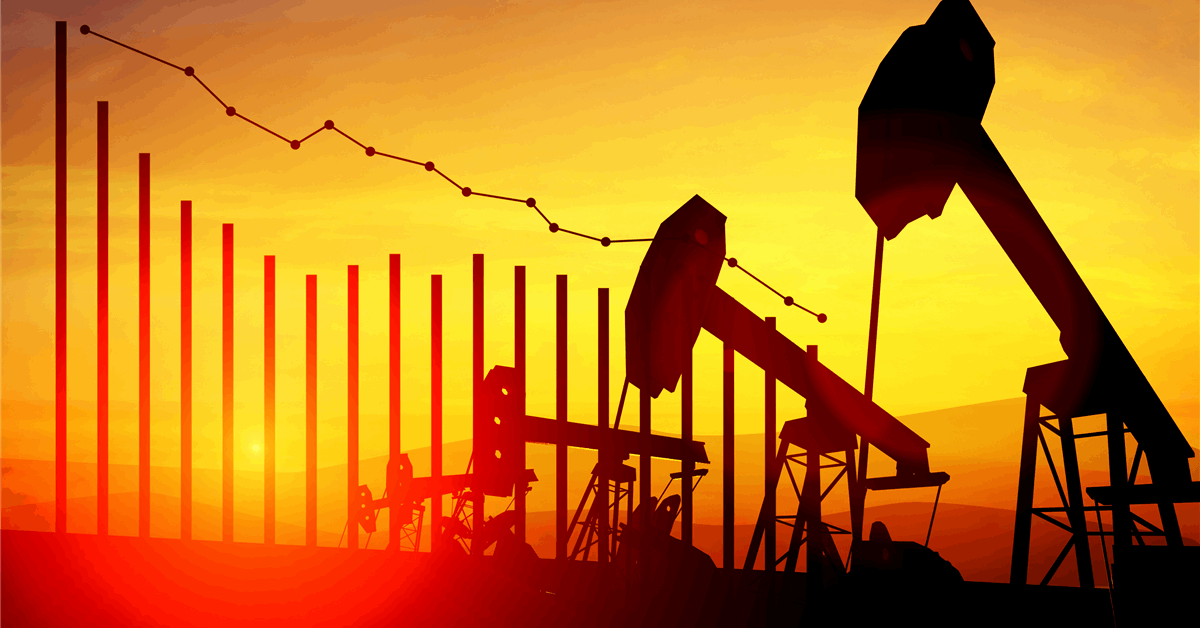

Oil edged greater after a risky session as US President Donald Trump’s tariffs on Mexico had been delayed by a month and buyers assessed the levies’ potential to sluggish international financial development, undercutting issues about short-term provide constraints.

West Texas Intermediate rose 0.9% to finish the session above $73 a barrel, paring an earlier acquire of as a lot as 3.7%, after Mexico President Claudia Sheinbaum mentioned tariffs on her nation could be pushed again by one month after a dialog with Trump on Monday.

Trump additionally spoke with Canadian Prime Minister Justin Trudeau and mentioned he’d discuss with him once more afterward Monday, opening the prospect of a last-minute deal. Trump introduced earlier that Canadian power exports could be taxed at 10%, decrease than the 25% tariffs beforehand introduced.

WTI futures jumped earlier within the session, outpacing the acquire in international benchmark Brent, reflecting doubtlessly greater demand for US provides to backfill any discount within the 4 million barrels a day that circulate to the US from Canada. The positive factors later pale — and WTI even briefly turned adverse — as falling equities markets and a acquire within the greenback signaled buyers’ issues that the commerce battle will hamper the worldwide financial system.

“Tariffs on the US’s largest crude oil provider are offering a lift to crude oil costs and specifically refined product costs,” mentioned Warren Patterson, head of commodities technique for ING Groep NV. “Whereas this can be supportive within the very brief time period, we could not want to attend too lengthy for a risk-off transfer because it raises issues over international development.”

Along with Canadian flows, the US additionally imports about 500,000 barrels of crude a day from Mexico. Reflecting expectations that refiners will face greater prices, gasoline futures soared as a lot as 6.5% in New York.

Crude has fallen since Trump, who has additionally pledged to “positively” impose tariffs on the European Union, was inaugurated on Jan. 20, pushed by the risk tariffs pose to development and his requires OPEC to decrease costs. Regardless of Trump’s push, OPEC+ didn’t make any modifications to its present oil-production plans at a overview assembly on Monday.

Gas producers within the Midwest depend on Canada’s heavy crude, and the affect may also be felt on the storage hub in Cushing, Oklahoma, which helps worth US crude futures, in addition to on the Gulf Coast, the place Mexican provides will likely be topic to a 25% levy.

Refiner Irving Oil Ltd., which operates the 320,000-barrel-a-day Saint John refinery in New Brunswick that sells most of its fuels to the US, has already begun boosting costs.

“The symbiotic relationship between Canadian producers and refiners within the Midwest is not any secret,” Barclays analyst Amarpreet Singh wrote in a notice. “Nor are the restricted avenues for substitution for each, however Canadian producers are arguably extra weak just because refiners is usually a bit extra versatile and midstream constraints are much less extreme for them.”

Oil Costs:

- WTI for March supply rose 0.9% to settle at $73.16 a barrel in New York.

- Brent for April settlement climbed 0.4% to $75.96 a barrel.

What do you suppose? We’d love to listen to from you, be part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all power professionals to Communicate Up about our trade, share data, join with friends and trade insiders and have interaction in knowledgeable group that may empower your profession in power.

MORE FROM THIS AUTHOR

Bloomberg