Woodside Vitality Group Ltd. mentioned Wednesday it had utilized to drag out its shares from the London Inventory Change to chop prices.

“Woodside has reviewed its present itemizing construction and determined to delist from the London Inventory Change (LSE)”, the oil and gasoline exploration and manufacturing firm mentioned in a press release. “Woodside shares represented by depositary pursuits account for roughly 1 p.c of Woodside’s issued share capital.

“Buying and selling volumes of Woodside shares on the LSE are low and delisting from the LSE will scale back Woodside’s administration prices”.

The associated fee-cutting transfer comes after Perth, Australia-based Woodside dedicated billions to new acquisitions. It mentioned September 20 it had accomplished the $2.35 billion buy of an under-construction ammonia manufacturing challenge in Beaumont, Texas, from OCI International. Twenty p.c of the worth has but to be paid. On October 9 Woodside introduced the closure of its $1.2 billion acquisition of Tellurian Inc., taking on the under-construction U.S. Gulf Coast Driftwood LNG challenge.

Final month Woodside, a significant liquefied pure gasoline (LNG) participant in Australia, additionally acquired new debt with the issuance of senior unsecured United States greenback bonds with a principal quantity of $2 billion. That consists of $1.25 billion due in 10 years and $750 million maturing in 30 years. “The funds shall be used for basic company functions”, it mentioned in a press launch September 6.

Woodside expects to finish the cancelation of its London inventory on November 20, having to fulfill a required 20-day ready interval from the discover of supposed cancelation.

Woodside issued shares on the LSE June 2022 after buying the oil and gasoline portfolio of BHP Group Ltd. It additionally launched on the Australian Securities Change (ASX) and the New York Inventory Change (NYSE) following the acquisition.

Woodside mentioned it would proceed buying and selling on the ASX and the NYSE.

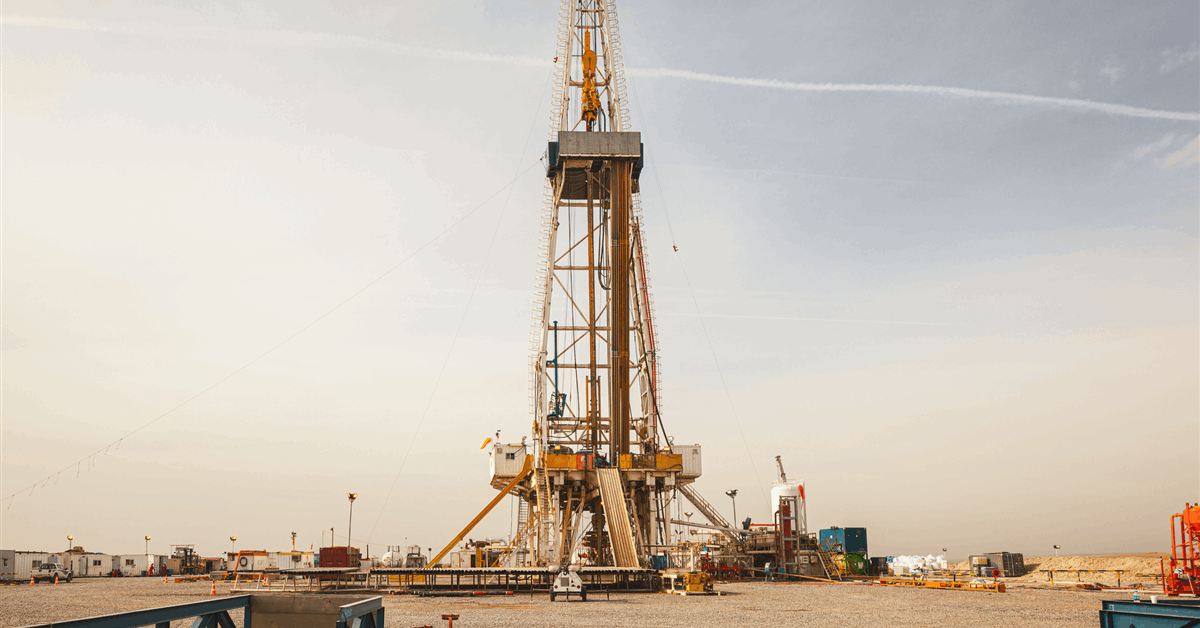

Additionally on Wednesday it revised up the decrease finish of its 2024 manufacturing steering and now tasks 189 million to 195 million barrels of oil equal (MMboe) because it reported a file quarterly output of 53.1 MMboe for the third quarter. The offshore Sangomar area in Senegal, the place Woodside owns a 90 p.c working stake, reached its nameplate capability of 100,000 barrels per day (bpd) gross within the interval after beginning manufacturing final June.

Woodside’s gasoline manufacturing within the July–September quarter averaged two billion cubic ft a day (Bcfd), unchanged in comparison with the identical interval final yr however up six p.c in opposition to the second quarter of 2024. Its liquid manufacturing totaled 226 million bpd, up 34 p.c year-on-year and 44 p.c quarter-on-quarter.

It bought 2.2 Bcfd of gasoline and 228 MMbpd of liquids within the third quarter of 2024.

Woodside logged $3.7 billion in income, up 13 p.c year-over-year and 21 p.c quarter-on-quarter because of larger gross sales volumes and LNG costs.

“Our 39 p.c publicity to LNG gasoline hub indices allowed us to reap the benefits of elevated LNG spot costs available in the market over the interval, demonstrating the significance of sustaining a balanced and versatile portfolio”, chief government Meg O’Neill mentioned.

To contact the writer, e mail jov.onsat@rigzone.com

What do you assume? We’d love to listen to from you, be part of the dialog on the

Rigzone Vitality Community.

The Rigzone Vitality Community is a brand new social expertise created for you and all vitality professionals to Communicate Up about our business, share information, join with friends and business insiders and interact in an expert neighborhood that can empower your profession in vitality.