The vitality market implications of a Ukraine-Russia ceasefire could possibly be large.

That’s what Rystad Vitality’s Head of Geopolitical Evaluation, Jorge Leon, mentioned in a breaking information market replace despatched to Rigzone on Wednesday by the Rystad group. Leon highlighted within the replace, nonetheless, that it’s “nonetheless early within the course of”.

“As early market reactions to yesterday’s information have proven, the geopolitical danger premium within the oil and fuel markets will fall sharply if a truce is carried out, bringing down costs,” Leon mentioned within the replace.

“Extra importantly, the chance of a everlasting peace settlement has now elevated in comparison with only a few days in the past, after the notorious televised conflict between President Zelensky and President Trump within the Oval Workplace,” he added.

“Along with the apparent humanitarian advantages, a everlasting ceasefire between Russia and Ukraine would have wide-ranging and sweeping implications for international vitality markets,” he continued.

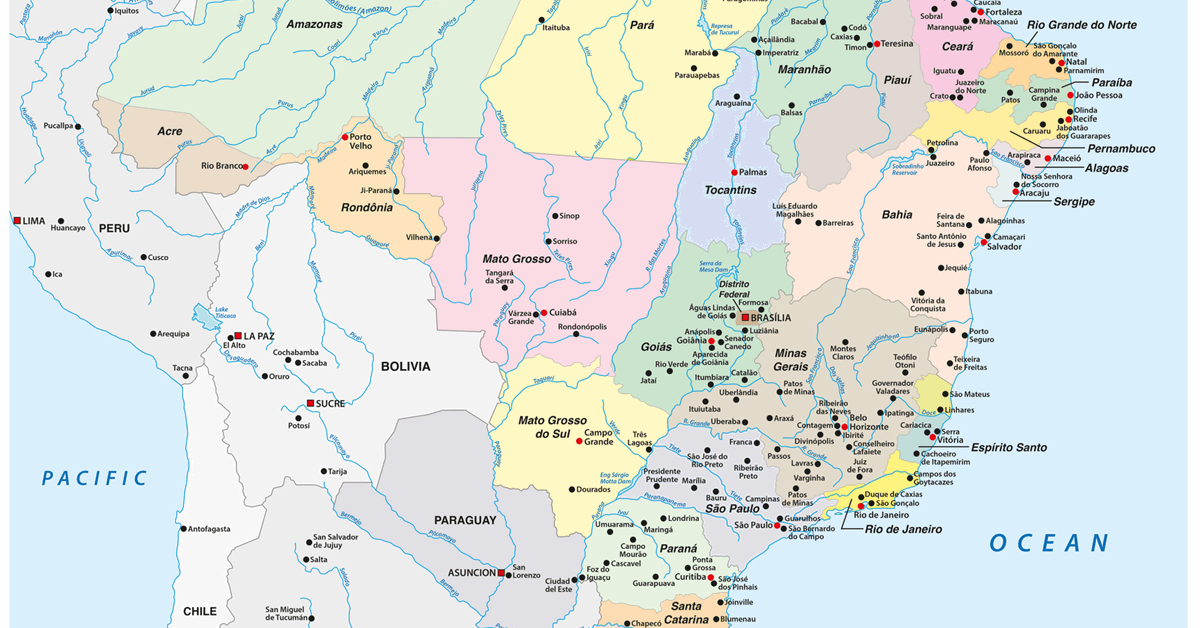

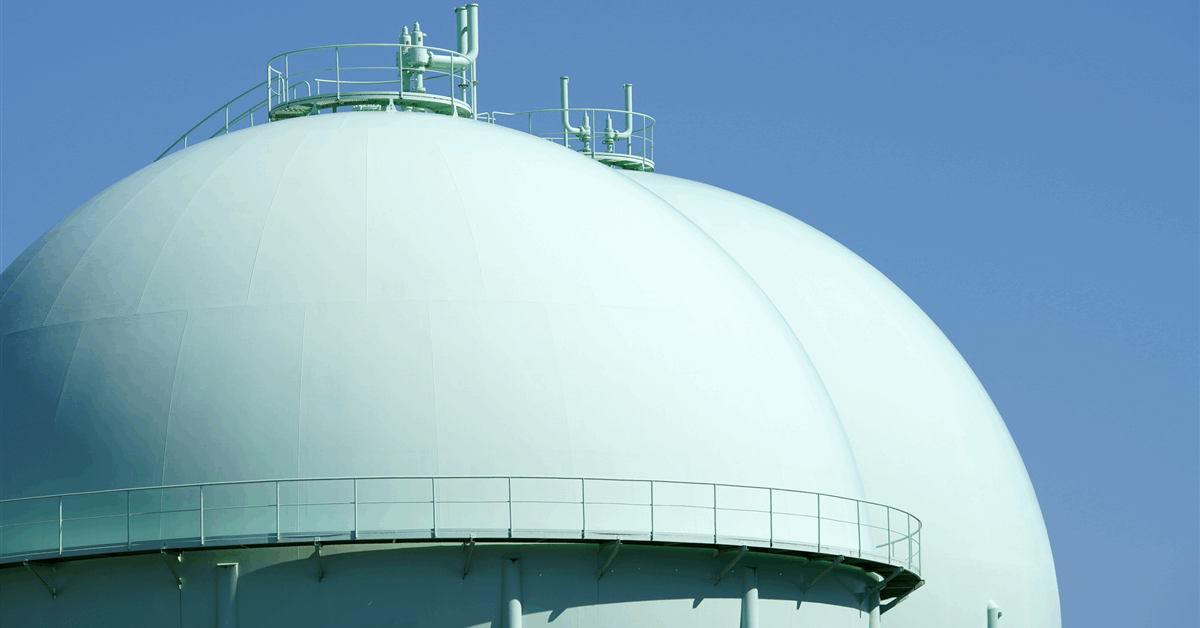

Leon famous within the replace {that a} ceasefire would most positively embody sanctions aid on Russian hydrocarbons, including {that a} better availability of Russian fuel would push costs down, notably the European fuel benchmark TTF.

For oil, draw back value strain triggered by a everlasting ceasefire is perhaps extra restricted, Leon mentioned within the replace.

“Russian crude manufacturing is restricted by its OPEC+ goal and never a lot by sanctions, however larger flows might materialize,” he mentioned.

“On the similar time, the tip of hostilities would cut back the geopolitical danger premium within the oil markets,” he added.

“Curiously, a decrease oil value is perhaps extra conducive for the U.S. to use most strain on Iran,” Leon famous.

“The Trump administration might contemplate it simpler to use most strain on Iran and lose round 1.5 million barrels per day of Iranian exports in a low-price setting with OPEC+ growing manufacturing and amid rising Russian provides,” he went on to state.

Leon mentioned within the replace that international commerce flows might additionally shift if a negotiated peace is reached.

“As such, a resumption of some Russian piped fuel to Europe might materialize,” Leon highlighted.

“We’re nonetheless far-off from a everlasting ceasefire settlement between Russia and Ukraine, however these developments supply a glimmer of hope,” he added.

Rigzone has contacted the Trump transition group, the White Home, the Division of Data and Press of the Russian Ministry of Overseas Affairs, the Press Workplace of the Ministry of Overseas Affairs of Ukraine, the Iranian Ministry of Overseas Affairs, and the European Fee Chief Spokesperson for touch upon Leon’s assertion.

On the time of writing, not one of the above have responded to Rigzone.

Jorge Leon is described on Rystad’s web site as an vitality economist with greater than 15 years of expertise in analysis and consulting within the vitality sector, “with important experience in monitoring, analyzing, and forecasting world vitality and oil developments”.

From 2018 to 2022 he was a part of BP’s Financial and Vitality Insights group in London, the location highlights. He labored on the Group of the Petroleum Exporting Nations from 2013 to 2018, Rystad’s web site factors out.

Rystad describes itself on its web site as an unbiased analysis and vitality intelligence firm, “equipping shoppers with knowledge, insights and training that energy higher decision-making”.

To contact the creator, e mail andreas.exarheas@rigzone.com