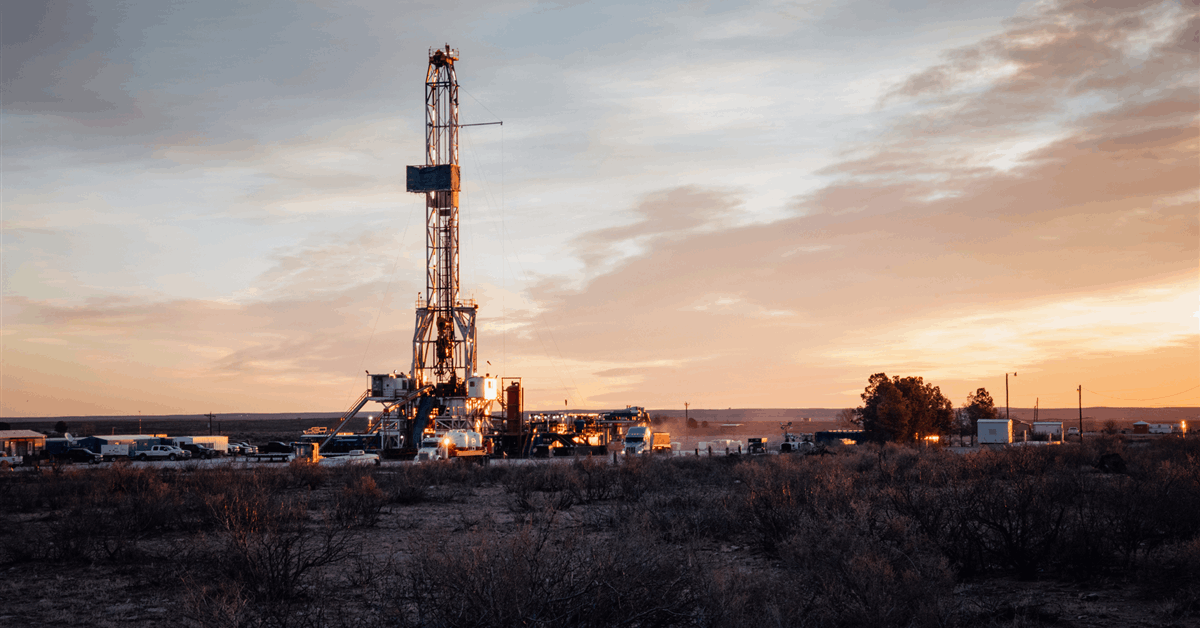

TC Power Corp. spinoff South Bow Corp. has reported a web revenue of $55 million for the fourth quarter and $316 million for the complete yr 2024. The corporate mentioned in a media launch the robust outcomes mirror the extremely contracted nature of its belongings.

Income and normalized earnings earlier than curiosity, revenue taxes, depreciation, and amortization (normalized EBITDA) elevated relative to 2023 on account of important demand for uncommitted capability on the Keystone Pipeline within the first quarter of 2024, and robust demand for capability on the U.S. Gulf Coast phase of the Keystone Pipeline System all year long, South Bow mentioned.

The corporate reported income of $488 million and $2.12 billion for the three months and yr ended December 31, 2024, respectively.

South Bow mentioned it delivered report system availability with an annual System Working Issue (SOF) of 95 % for the Keystone Pipeline on account of continued enhancements in system reliability. It recorded an annual common throughput on the Keystone Pipeline of roughly 626,000 barrels per day (bpd) in 2024, a rise of 5 % relative to 2023. Throughput on the U.S. Gulf Coast phase of the Keystone Pipeline System averaged roughly 795,000 bpd, rising by 15 % relative to 2023, South Bow mentioned.

Fourth-quarter 2024 throughput on the Keystone Pipeline and the U.S. Gulf Coast phase of the Keystone Pipeline System averaged roughly 621,000 bpd and roughly 784,000 bbl/d, respectively, it mentioned.

South Bow mentioned that about 90 % of its adjusted EBITDA is secured by means of agreements with minimal commodity worth or quantity dangers. Nonetheless, demand for uncommitted capability on the Keystone System is predicted to stay low in 2025, as pipeline capability within the Western Canadian Sedimentary Basin (WCSB) exceeds provide, it mentioned.

Tariffs on power by the U.S. authorities and corresponding Canadian counter-tariffs have created financial uncertainty that impacts pricing differentials, South Bow famous. This ongoing uncertainty could create challenges for uncommitted capability on South Bow’s pipeline techniques and impression the Advertising phase’s outcomes. Due to this fact, South Bow’s 2025 forecast doesn’t embody the potential results of sustained tariffs, the corporate mentioned.

The 2025 forecast estimates normalized EBITDA at roughly $1.01 billion, with a 3 % variance and round 90 % secured by means of dedicated agreements. South Bow has maintained its long-term normalized EBITDA progress outlook of two % to three %.

South Bow mentioned it plans to take a position roughly $110 million, inside a 3 % vary, for progress capital expenditures on the Blackrod Connection Challenge in 2025, with whole challenge prices anticipated at $180 million. Completion is focused for early 2026. As of December 31, 2024, $62 million has already been invested within the challenge, the corporate mentioned.

Upkeep and capital expenditures are estimated at $65 million, with a 3 % vary, for 2025 as South Bow proactively engages in upkeep actions whereas demand for uncommitted capability is predicted to be low and continues to put money into info companies infrastructure, the corporate mentioned.

To contact the writer, electronic mail andreson.n.paul@gmail.com

What do you suppose? We’d love to listen to from you, be part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all power professionals to Converse Up about our business, share data, join with friends and business insiders and have interaction in an expert group that can empower your profession in power.