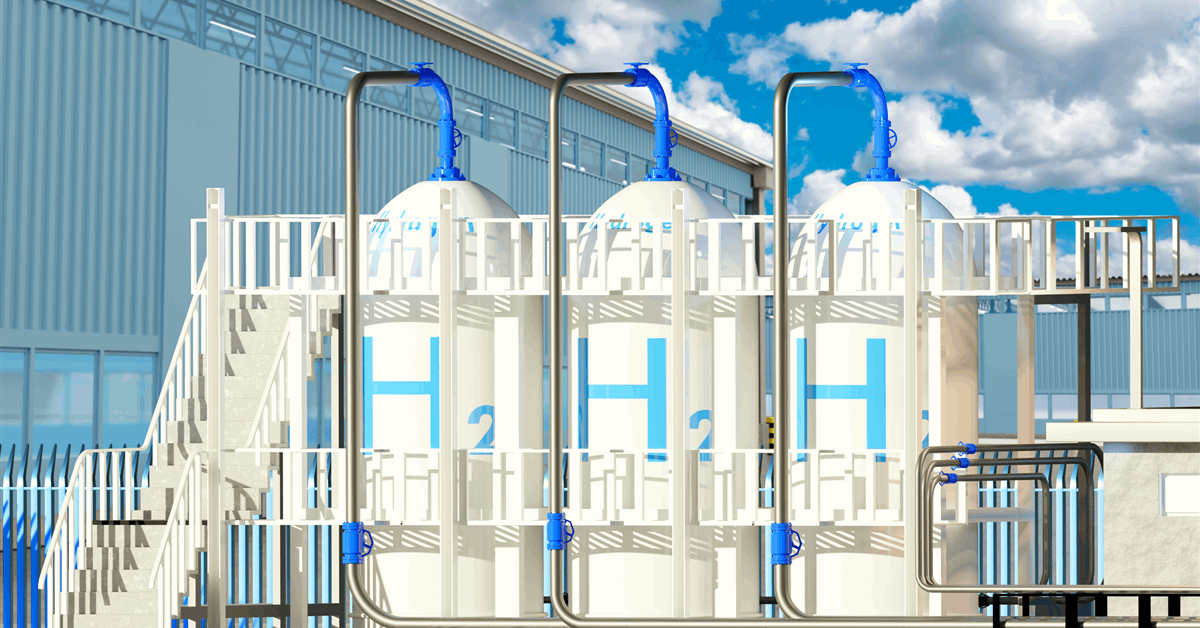

Power prices may come down as European gasoline storage services are anticipated to finish the winter season at a document of greater than 50% full.

Modelling accomplished by power consultancy Cornwall Perception suggests gasoline provides are safe after issues of shortages following Russia’s invasion of Ukraine.

Fuller storage items imply much less future demand for gasoline, which may carry down costs.

Storage services throughout Europe will finish winter between 45% and 61% full – a median of 55% capability – bypassing the earlier finish of winter document of 54% in 2020.

Following the beginning of the battle in Ukraine, European nations raced to scale back their reliance on Russian gasoline, which pushed up costs and led to issues about power provides in winter 2022 to 2023.

Having a larger quantity of gasoline in storage means extra is prepared for winter 2023-2024 and fewer must be purchased, leaving provides safer than in 2022.

It’s a doubling from final 12 months.

On 31 March 2022 simply 26% of European storage services have been crammed, based on knowledge from Gasoline Infrastructure Europe.

There was concern that the lights couldn’t be saved on amid gasoline shortages. Within the UK the Nationwide Grid’s Electrical energy System Operator had warned in October that deliberate three-hour energy blackouts could possibly be imposed within the occasion of gasoline provides falling wanting demand.

Click on to subscribe to the Sky Information Day by day wherever you get your podcasts

To cut back power demand and address potential shortages, EU nations formally agreed a voluntary 10% minimize in gross electrical energy consumption and a compulsory discount of 5% throughout peak use hours.

However excessive gasoline storage ranges this 12 months don’t imply costs will drop to lows seen on the finish of earlier excessive storage-level winters.

Regardless of the “significantly extra optimistic” forecasts, the lead analysis analyst at Cornwall Perception mentioned he was cautious about saying Europe is over the worst of the power disaster.

“Any single issue can affect the tempo and sample of storage refill, and maybe extra pertinently, change the price paid to attain it,” Dr Matthew Chadwick mentioned.

“We’re definitely not out of the woods but.”

Learn extra

The small pipeline enjoying an outsized position within the power disaster

The surreal, but in addition actual, drawback of Britain’s gasoline glut

Components that would carry up power prices embody climate, US exports, Chinese language demand and Russian provides.

Whereas a gentle winter helped protect gasoline shares, a summer time with heatwaves would carry power demand for air-conditioning and followers.

Imports of US liquified pure gasoline within the second half of final 12 months rose considerably as reliance on Russian gasoline waned. Going ahead, nonetheless, the US is underneath home strain to guard shoppers from worth rises, which may imply much less exported to Europe.

Russian gasoline remains to be relied on by Europe and can proceed to be wanted.

The reopening of China, following almost three years of lockdown restrictions, and the related financial development will impression power markets, the Cornwall Perception report mentioned, although the impression is unsure.

For these trying to hear excellent news about payments, Dr Chadwick shouldn’t be the barer.

“Regardless of the outlook for storage ranges, the necessity to compensate for Russian pipeline volumes with costly and risky liquified pure gasoline will maintain gasoline payments larger,” he mentioned.

“This, not less than for now, is the “new regular”, and shoppers and economies ought to put together for power prices to stay larger than earlier than the pandemic, and the Ukraine struggle, for a while to come back.”

Households can anticipate costs to be “extra muted” than final 12 months, Dr Chadwick mentioned, because the panic from the Ukraine struggle outbreak subsides.

“What could ease this 12 months is the heightened degree of comprehensible panic that led to hectic energy-buying practices throughout the autumn of 2022.

“Consequently, we will most likely anticipate costs to be rather more muted than 2022, regardless of any uncertainties which will come into play.”

Gasoline storage services within the UK embody Tough, a facility reopened this 12 months off the Yorkshire coast, and the Stublach onshore facility in Cheshire.