Petro-Victory Power Corp and BlueOak Investments mentioned they’ve signed a sale and buy settlement to accumulate onshore Brazilian manufacturing agency Capixaba Energia LTDA.

The transaction value is $17.5 million, together with earn-outs, funded by BlueOak and future money flows. The transaction is anticipated to shut within the second quarter, Petro-Victory mentioned in a information launch.

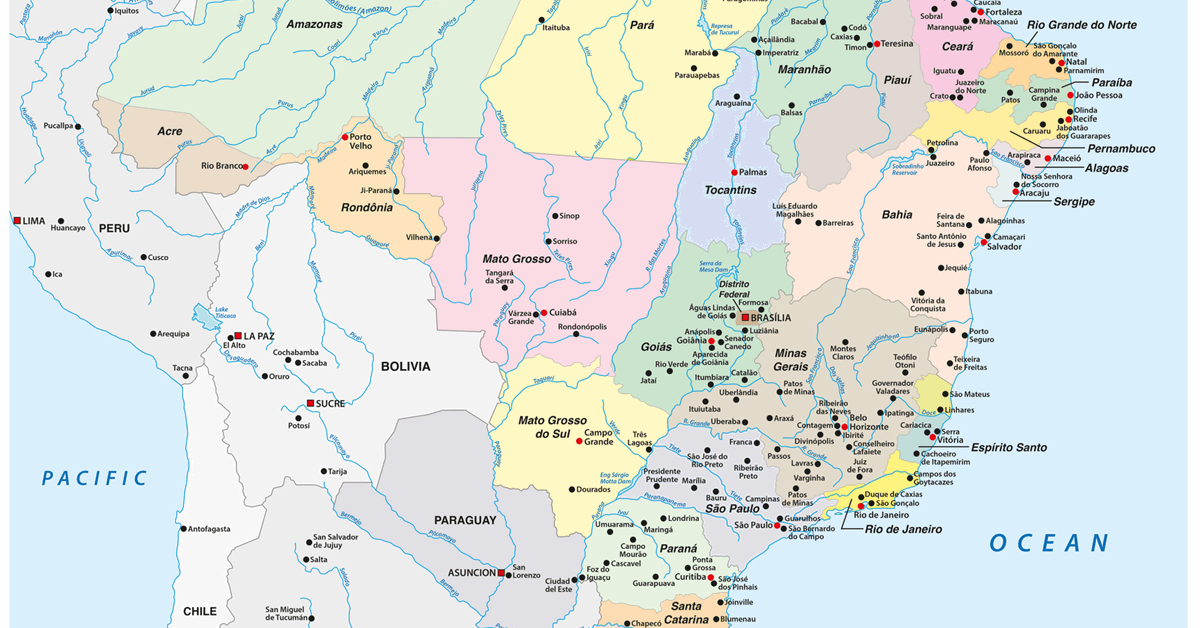

The acquisition contains 4 oil fields within the Espírito Santo Basin, together with the Lagoa Parda Cluster, plus two exploration blocks adjoining to main producers, in keeping with the discharge.

BlueOak will fund 100% of the acquisition and would be the controller, whereas Petro-Victory would be the operator. Petro-Victory will start with a nominal fairness place at closing and can develop into a related fairness holder upon reaching sure thresholds, the corporate mentioned.

The property have a present output of roughly 400 barrels of oil equal per day (boepd), consisting of 88 % oil, with expectations to develop considerably throughout the subsequent 12 to 18 months following an in depth and deliberate workover and drilling marketing campaign concentrating on confirmed reserves, the corporate mentioned.

Petro-Victory mentioned it shaped a three way partnership with BlueOak final month to ascertain the phrases and situations governing the acquisition of Capixaba Energia, which generates robust money move and owns essential infrastructure property, “positioning Petro-Victory and BlueOak for accelerated development in Brazil’s onshore oil and gasoline sector”.

Petro-Victory famous that it has beforehand partnered within the Lagoa Parda Cluster, “gaining precious technical experience and business relationships”. The work program will deal with maximizing manufacturing, bettering restoration charges, and optimizing working prices, it mentioned.

Capixaba Energia has a licensed reserve report from December 2019. Petro-Victory mentioned a brand new reserve report is being ready by an unbiased reserves evaluator and will probably be revealed when out there.

The report is anticipated to extend licensed reserves, the corporate mentioned. The sphere has produced 38 million barrels up to now, with substantial reserves remaining, in keeping with the discharge.

Petro-Victory CEO Richard Gonzalez mentioned, “I’m more than happy to announce our first acquisition in partnership with BlueOak. The acquisition of Capixaba Energia marks a strategic milestone in our growth, as we set up a hub of manufacturing and experience within the Espírito Santo area. This acquisition strengthens our place in Brazil, firmly establishing Espírito Santo basin as a key space for manufacturing development and complementing our presence within the Barreirinhas and Potiguar basins, the place we’re already well-positioned. We sit up for unlocking the complete potential of those property and driving long-term worth creation with BlueOak”.

BlueOak CEO Meton Morais mentioned, “Our funding in Capixaba Energia, in partnership with Petro-Victory, marks a pivotal step in our dedication to unlocking worth within the Brazilian vitality sector. Brazil is an more and more engaging marketplace for oil and gasoline funding and presently has extra sellers than patrons of onshore property. The Espírito Santo onshore basin affords a singular consolidation alternative, provided that we don’t see a serious structured and capitalized participant investing within the improvement of its property. We sit up for a profitable partnership with Petro-Victory as we drive development and create sustainable worth by way of operational excellence and disciplined capital allocation”.

To contact the writer, e-mail rocky.teodoro@rigzone.com

Generated by readers, the feedback included herein don’t mirror the views and opinions of Rigzone. All feedback are topic to editorial evaluate. Off-topic, inappropriate or insulting feedback will probably be eliminated.