Oil merchants are divided over whether or not OPEC+ will proceed with plans to revive manufacturing in December, as crude costs falter amid a fragile financial outlook.

The alliance led by Saudi Arabia and Russia is because of start a sequence of month-to-month output will increase with a hike of 180,000 barrels a day in December, because it steadily revives provides halted since 2022.

However the producers have already delayed the restart — initially scheduled for October — amid weakening oil demand and swelling rival manufacturing. With little signal of enchancment, merchants and analysts surveyed by Bloomberg are not any extra assured the cartel is able to transfer now.

Sixteen of 30 survey respondents predicted that the Group of Petroleum Exporting Nations and its companions will choose to delay the hike. The group might want to determine within the subsequent couple of weeks, in time to inform clients.

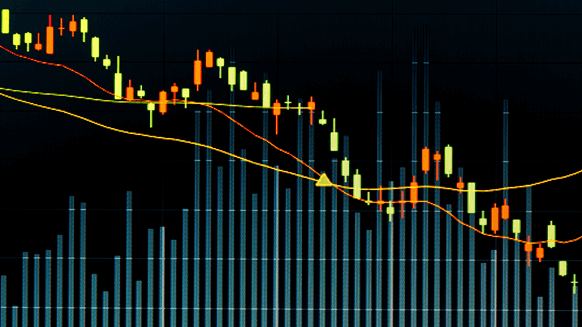

In the meantime, oil futures have slumped 18% since early July, ignoring battle within the Center East as demand frays in key client China and output climbs within the US, Brazil, Canada and Guyana. At about $72 a barrel in London, costs are too low for a lot of OPEC+ members like Saudi Arabia to cowl authorities spending.

“The largest downside for oil demand is China,” mentioned Henning Gloystein, head of vitality and local weather at consultants Eurasia Group. “This can put the Center East-dominated producer membership OPEC in a tough place.”

Consumption within the Asian nation contracted for 4 straight months, inflicting international oil demand to develop on the slowest tempo for the reason that 2020 pandemic, the Worldwide Vitality Company estimates. Demand development of roughly 1 million barrels a day — or about 1% — shall be eclipsed by a provide surge of 1.5 million barrels subsequent 12 months, saddling world markets with a brand new glut, in line with the IEA.

Decrease Worth Menace

Costs are headed into the $60s subsequent 12 months, and probably decrease if OPEC+ opens the faucets, in line with Citigroup Inc. and JPMorgan Chase & Co.

That poses a monetary menace for Riyadh, which wants ranges nearer to $100 a barrel to cowl the bold financial plans of Crown Prince Mohammed bin Salman, in line with the Worldwide Financial Fund. The dominion’s oil-market associate, Russian President Vladimir Putin, seeks to finance his conflict in opposition to Ukraine.

Saudi Vitality Minister Prince Abdulaziz bin Salman has usually urged the group to be cautious in including barrels again to the market. When OPEC+ deliberated the availability restart final month, merchants’ expectations have been equally divided.

“Sentiment is weak and will take an extra hit if OPEC+ go forward with the rise,” mentioned Ole Sloth Hansen, head of commodity technique at Saxo Financial institution A/S in Copenhagen.

Nonetheless, the remaining 14 survey respondents predict the producers will go forward with the December increment. World oil inventories have been depleted following summer season driving demand within the US and elsewhere, they contend. And OPEC+ can’t postpone its roadmap for reviving output indefinitely, mentioned one official who requested to not be recognized.

“The market isn’t precisely super-tight, however it’s comfortable,” mentioned Jeff Currie, chief technique officer for vitality pathways at Carlyle Group. This offers “OPEC+ scope to convey again manufacturing on a data-dependent foundation.”

US Election ‘Shockwave’

The market outlook the group faces finally hinges on the end result of US presidential elections on Nov. 5, Currie added.

“The actual geopolitical danger has but to come back, which is the shockwave from the US election,” he mentioned. “Not solely will it jar fragile flash factors around the globe, however it can additionally reveal the all-important path that Chinese language stimulus takes in response.”

Individually, the United Arab Emirates, a key member, has usually appeared desperate to deploy new manufacturing capability, which it says is considerably increased than present output ranges. Abu Dhabi has secured a particular association so as to add some barrels no matter whether or not the group-wide hikes proceed.

OPEC+ has agreed to revive a complete of two.2 million barrels per day of halted output in month-to-month tranches by to late 2025. Ministers will collect on Dec. 1 to think about the hikes scheduled for early subsequent 12 months.

Their coverage may depend upon the alliance’s least compliant members: Iraq and Kazakhstan.

OPEC’s management has pressured the 2 nations for failing to implement their share of cutbacks pledged initially of the 12 months. Whereas they’ve proven some latest enchancment, and promised additional curbs to compensate for overproducing, they’re nonetheless pumping above their designated quotas.

Riyadh may develop sufficiently pissed off with shouldering the burden that it opts to speed up the time-table of provide will increase, in line with RBC Capital Markets LLC. However others suspect the group could look forward to the laggards to meet their promised reductions first.

“I’d anticipate the market would wish to see proof of compensatory cuts earlier than some provides will be introduced again,” mentioned Aldo Spanjer, commodities strategist at BNP Paribas SA. “Returning earlier than proof of compensatory cuts would possibly induce one other dump. Provided that, I’d anticipate a roll over in December.”