In a report despatched to Rigzone at present, Bjarne Schieldrop, the Chief Commodities Analyst at Skandinaviska Enskilda Banken AB (SEB), highlighted that the oil market is “battling between spike-risk versus 2025 surplus”.

“Brent crude fell 7.6 % final week following a rally to $81.16 per barrel the week earlier than when it felt like a retaliatory assault by Israel on Iran was imminent with all targets attainable,” Schieldrop mentioned within the report.

“Israel has promised that ‘Iran can pay’ for its assault on Israel on 1 October when it fired 200 ballistic missiles at Israel. However days handed by and no retaliation occurred. Fears that Israel will go after Iranian oil installations and nuclear amenities additionally appears to have pale,” he added.

“Biden has urged Israel to not hit such targets. Israel has mentioned that it’s going to make its personal selections so it’s nonetheless an open threat that Israel might certainly hit Iranian oil installations,” he continued.

Within the report, Schieldrop revealed that, to SEB, “it looks like near sure that Israel will certainly retaliate sooner or later”. The analyst warned within the report that this could probably be “laborious and forceful and never a muted retaliation like in April”.

Schieldrop identified within the report, nevertheless, that, “so long as nothing occurs on a each day foundation, the oil value falls again with market focus circling again to issues over a surplus of oil in 2025 the place OPEC wants to chop one other 0.9 million barrels per day to maintain it in steadiness, in accordance with the most recent report from the Worldwide Power Company”.

“OPEC+ planning so as to add barrels to the market from December onward makes that look even worse in fact,” he added.

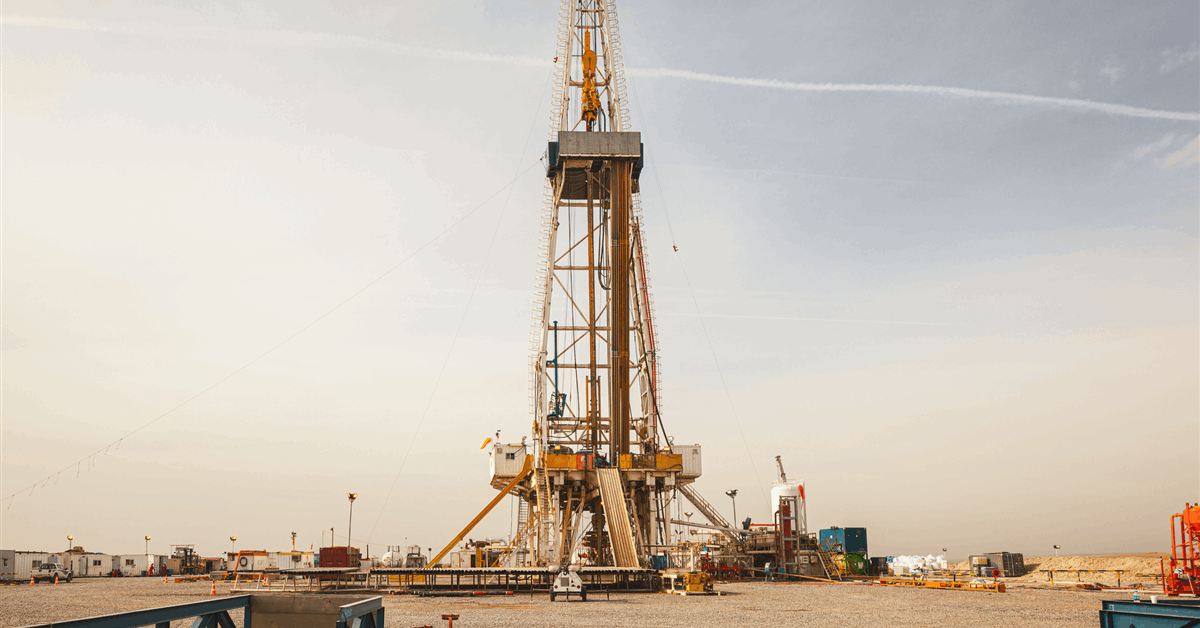

Crude Has Been Operating Tight

Within the report, Schieldrop famous that, over the previous three years, the oil market has been working tight.

“Tight on merchandise and tight on crude. The long-dated Brent crude five-year contract, or the 60-month contract, has been very secure at near $70 per barrel,” he mentioned.

“The front-end Brent crude contract nevertheless has traded at a premium of $28 per barrel, $15 per barrel and $12 per barrel for 2022, 2023, and 2024 respectively versus the 60-month contract,” he added.

“If the oil market subsequent 12 months flips to a surplus with rising inventories then the market ought to naturally flip to a contango-market,” he continued.

The implication of that’s that the front-end Brent contract will commerce at a reduction to the longer dated Brent value, Schieldrop acknowledged within the report.

“The Brent 1 month value would then usually be $70 per barrel (long-dated 60-month value) minus some low cost of perhaps $5-10 per barrel. Implying a Brent 1 month value of $60-65 per barrel,” he mentioned.

“That is what the oil bears are eyeing for 2025 and why we’ve got seen such overly bearish positioning these days,” he continued.

Schieldrop acknowledged within the report that, counter to such a growth can be attainable injury to Iranian oil provides because of the forthcoming Israeli retaliation.

“Or within the following re-re-re-re-retaliations after that,” he warned.

“Or that Donald Trump is elected president and extra strictly enforces sanctions on Iranian oil exports thus making room for extra exports from the remainder of OPEC+,” he added.

Positive aspects

In a market evaluation despatched to Rigzone round noon at present, Samer Hasn, a Senior Market Analyst at XS.com, highlighted that crude oil was up practically one % “throughout each main benchmarks, following a five-day shedding streak”.

“Oil’s features come after the Individuals’s Financial institution of China minimize rates of interest greater than anticipated as a part of a sequence of financial stimulus measures that ought to help demand prospects for crude,” Hasn mentioned within the evaluation.

“This comes amid rising indicators of additional escalation within the Center East and the dearth of a decision within the horizon, which might maintain the door open for a return of the geopolitical threat premium to crude costs,” he added.

“The PBOC’s minimize its Mortgage Prime Price for one and 5 by 25 foundation factors to three.1 % and three.6 %, respectively. The anticipated transfer follows a sequence of earlier measures geared toward supporting debtors, significantly within the struggling housing market,” he continued.

Regardless of the market’s welcome of the transfer, it has been met with skepticism, together with different earlier financial measures, concerning the effectiveness in supporting the financial system, Hasn acknowledged within the evaluation.

“What the central financial institution is doing alone is not going to be sufficient, as demand for credit score continues to be weak within the first place, in accordance with the Wall Avenue Journal, citing Capital Economics. Considerably restoring financial development requires giant fiscal help, not simply financial help,” Hasn highlighted.

“As such, I consider that oil’s features, supported by financial elements from China, could also be fragile and topic to fast reversal,” he warned.

“This transfer additionally comes after the slowdown in GDP development over the last quarter, in addition to the slowdown in shopper value inflation and the contraction of producer costs quicker than anticipated, along with the continued contraction in home costs, indicating continued weak demand,” he continued.

Wanting on the Center East within the evaluation, Hasn mentioned “the prospect of regional conflict looms ever bigger, with no indicators of de-escalation from Israel, leaving the door vast open for additional battle”.

“Even after discuss of hope for a truce following the killing of Hamas chief Yahya Sinwar, there aren’t any indications of imminent ceasefire talks, and the escalation has truly worsened over the weekend, in accordance with the New York Instances,” he added.

Crude Stabilizes After Sharp Declines

In a separate market evaluation despatched to Rigzone earlier at present, Joseph Dahrieh, a Managing Principal at Tickmill, mentioned “crude oil futures have stabilized to a sure extent after final week’s sharp declines, as issues over weakening demand in China weighed on market sentiment”.

“China’s financial slowdown, now at its weakest development price since early 2023, continues to dampen expectations for a fast restoration in oil demand, regardless of ongoing Beijing… stimulus efforts,” he added.

“This has saved costs below strain as traders monitor whether or not China can increase its demand,” he continued.

On the identical time, altering geopolitical situations proceed to have an effect on the market, Dahrieh acknowledged within the evaluation.

“Regardless of U.S. President Biden hinting at a possible de-escalation, briefly relieving strain on costs, tensions stay elevated, holding geopolitical dangers in focus and elevating the possibility of renewed market volatility,” he warned.

“On the provision aspect, decreased U.S. oil and fuel rig exercise might present help for costs if the development continues,” he added.

“In the meantime, Saudi Aramco’s CEO has expressed optimism about China’s oil demand, which is pushed by authorities stimulus and elevated wants for jet gasoline and petrochemicals. Stronger demand might increase costs,” Dahrieh went on to state.

To contact the creator, e mail andreas.exarheas@rigzone.com