The worldwide oil and fuel business skilled a 15 % quarter on quarter lower in complete contracts, GlobalData famous in a launch despatched to Rigzone just lately.

The corporate outlined within the launch that this determine dropped from 1,596 within the third quarter of final yr to 1,353 within the fourth quarter of 2024. Regardless of the dip in quantity, the general contract worth remained secure, pushed by the announcement of some main contracts in Africa, GlobalData said within the launch, which highlighted a latest firm report on oil and fuel business contracts.

This report revealed that total contract worth got here in at $39.2 billion within the fourth quarter and $38.8 billion within the third quarter, the discharge highlighted.

A chart displaying oil and fuel business contracts by scope within the fourth quarter of 2024, which was included within the launch, revealed that 670 contracts had an operations and upkeep scope, 403 contracts had a procurement scope, 139 contracts had a number of scopes, 78 contracts had a design and engineering scope, 62 had a building and set up scope, and one had an asset retirement scope.

“The main contracts introduced within the African area embrace Tecnicas Reunidas and Sinopec Engineering’s $4 billion new deep conversion oil refinery mission in Algeria’s Hassi Messaoud area, and $1.4 billion Wuhuan Engineering and WeDo’s ammonia and urea plant mission in Angola,” GlobalData mentioned within the launch.

The corporate said that another notable contracts throughout the quarter had been Bram Offshore and Starnav Servicos Maritimos’ $2.74 billion building and constitution contract from Petrobras for 12 Platform Provide Vessels (PSVs) and Saipem’s $1.9 billion contract from TotalEnergies EP Suriname for the EPC, provide, pre-commissioning, and commissioning help for the Subsea Umbilicals, Risers, and Flowlines (SURF) bundle for the GranMorgu mission in Suriname.

“These contracts show continued funding and enlargement in key international oil and fuel tasks,” GlobalData mentioned within the launch.

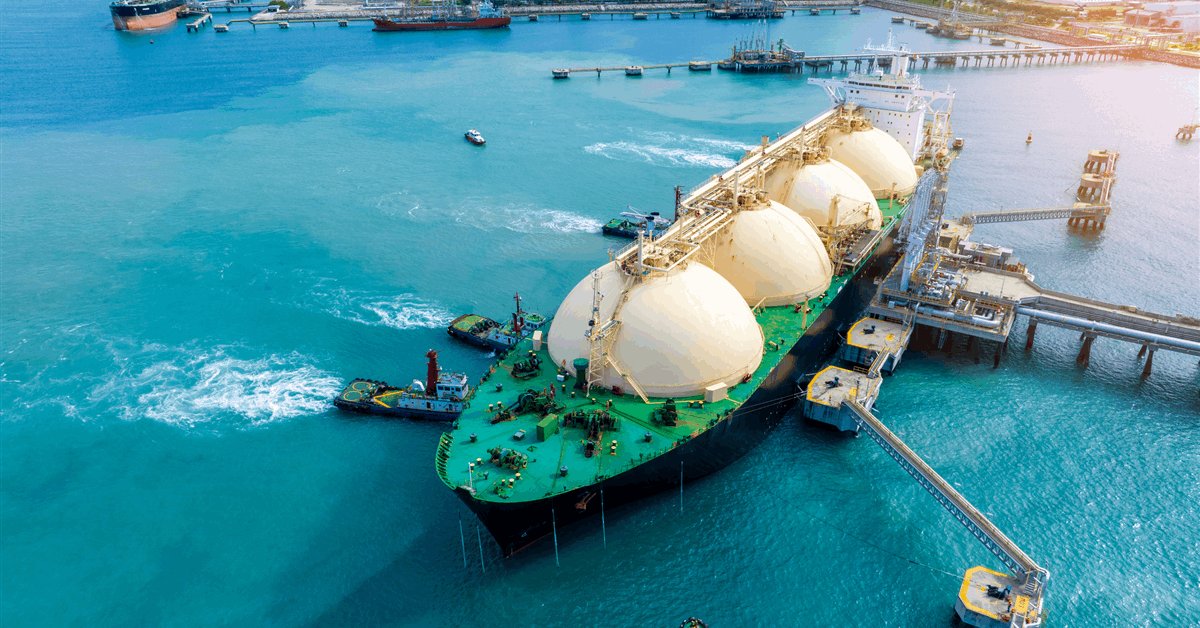

Pritam Kad, an oil and fuel analyst at GlobalData, said within the launch, “Sinopec Engineering changing Samsung Engineering to accomplice with Tecnicas Reunidas for the 5 million ton every year deep conversion refinery mission within the Hassi Messaoud area of Algeria was a big worth booster, together with the help from JGC Indonesia $2.4 billion compression contract for the Tangguh LNG contract, Saipem’s $1.9 billion GranMorgu subsea improvement contract in Suriname, and Wuhuan Engineering and WeDo’s contract for an ammonia and urea plant in Angola”.

“These contracts had been essential in conserving the contract worth secure regardless of the decline in quantity,” Kad added.

In a launch despatched to Rigzone again in November, GlobalData mentioned international oil and fuel contract exercise noticed a 35 % quarter on quarter lower in complete disclosed worth from $55.3 billion in Q2 2024 to $35.7 billion in Q3 2024.

“Regardless of this, regular contract volumes, significantly within the Center East, had been pushed by substantial tasks corresponding to Saipem’s $4 billion contract with QatarEnergy and multi billion greenback agreements from Saudi Aramco, offering some stability,” GlobalData said in that launch.

GlobalData’s newest oil and fuel business contract report on the time confirmed that total contract quantity got here in at 1,519 contracts in Q3 2024 and 1,546 in Q2 2024, that launch highlighted.

In that launch, Kad mentioned, “contract exercise within the Center East has supplied little stability, serving to to offset the general worth decline”.

“That is pushed by Saipem’s $4 billion contract from QatarEnergy LNG for the North Subject offshore compression program in Qatar and important contracts price over $3 billion from Saudi Aramco for Engineering, Procurement, Building, and Set up (EPCI) work on the Zuluf, Safaniyah, and Marjan subject improvement tasks in Saudi Arabia,” Kad added.

In one other launch despatched to Rigzone in February 2024, GlobalData mentioned the oil and fuel business “confronted a big quarter on quarter decline of 16 % in disclosed contract quantity from 1,401 in Q3 2023 to 1,172 in This fall 2023”.

“Nevertheless, regardless of this downturn, a marginal uptick in total contract worth hints at resilience throughout the difficult instances,” the corporate added in that launch.

GlobalData’s newest oil and fuel business contract report on the time revealed that total contract worth elevated from $46 billion in Q3 2023 to $48 billion in This fall 2023, that launch outlined.

On this launch, Kad mentioned, “the numerous contract worth within the quarter was largely pushed by Tecnimont, Saipem, and NPCC’s important contracts with ADNOC totaling $8.7 billion and $8.2 billion, respectively, for the Hail and Ghasha Growth Venture in Abu Dhabi, the UAE”.

“These contracts had been pivotal in elevating the oil and fuel contracts panorama, probably boosting alternatives for additional progress and collaboration within the area,” Kad added.

To contact the writer, e-mail andreas.exarheas@rigzone.com