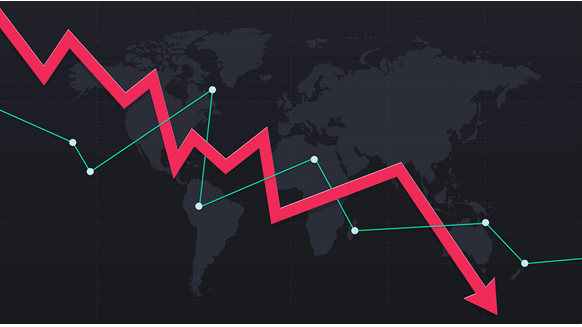

Oil declined after China’s extremely anticipated Finance Ministry briefing on Saturday lacked particular new incentives to spice up consumption on this planet’s greatest crude importer.

West Texas Intermediate fell round 2% to settle slightly below $74 a barrel whereas Brent additionally slumped. Regardless of Beijing’s guarantees of extra help for the struggling property sector and hints of higher authorities borrowing, the briefing didn’t produce the headline greenback determine for contemporary fiscal stimulus that the markets had sought. Information confirmed export development unexpectedly slowed, curbing a commerce rebound that had been a brilliant spot in a weakening economic system.

“The non-event of specifics from Chinese language officers a couple of new stimulus bundle locations one other dent in crude demand,” stated Dennis Kissler, senior vp for buying and selling at BOK Monetary Securities.

Including to the gloom, OPEC joined a refrain of others projecting weakening demand development. The group trimmed its forecasts this 12 months and subsequent for a 3rd consecutive month.

Within the choices market, merchants proceed to brace for Israel’s response to Iran’s Oct. 1 ballistic missile assault. For WTI, calls have been on the widest premium to places since 2022, when Russia invaded Ukraine. Weekly volumes for Brent choices have been the second-highest on file final week, having hit a weekly file the earlier week.

Oil Costs:

- WTI for November supply declined 2.3% to settle at $73.83 a barrel.

- Brent for December settlement dropped 2% to settle at $77.46 a barrel.

A report Saturday stated Israel had narrowed down potential targets to navy and power infrastructure. On Monday, Israel stated a contemporary barrage of missiles was fired from Lebanon a day after a Hezbollah drone strike killed 4 troopers. The Pentagon stated it could ship a sophisticated missile protection system and related troops to assist protect its ally.

WTI has risen round 8% this month because the prospect of an escalation within the Center East threatens output from a area that provides a couple of third of the world’s oil. The tensions have seen hedge funds flee bearish bets in opposition to the crude benchmark on the quickest tempo in practically eight years, whereas bearish bets on diesel futures plunged by probably the most on file.

“The market look worse to me when it comes to fundamentals however stays held hostage by geopolitics and is prone to keep that approach,” stated Scott Shelton, an power specialist at TP ICAP Group Plc.

What do you assume? We’d love to listen to from you, be a part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all power professionals to Communicate Up about our trade, share information, join with friends and trade insiders and interact in knowledgeable neighborhood that may empower your profession in power.

MORE FROM THIS AUTHOR

Bloomberg