Oil edged up as inside market metrics flashed indicators that latest declines had been overdone, overshadowing the prospect of a short lived truce in Ukraine.

West Texas Intermediate rose 0.3% to prime $66 a barrel, recovering from the bottom closing worth in six months. Ukraine mentioned it’s prepared to simply accept a US proposal for a 30-day truce in Russia’s conflict, elevating expectations that Moscow’s crude could once more stream freely within the close to future.

Oil held its floor Tuesday at the same time as contemporary commerce salvos from US President Donald Trump threatened to lengthen a plunge in danger property. Regardless of the weakening financial outlook weighing on futures costs in latest weeks, WTI’s immediate unfold — a key indicator of near-term provide and demand balances — has held regular in a bullish, backwardated construction. That’s an indication that the expansion scare for crude isn’t as extreme as for different property, mentioned Jon Byrne, an analyst at Strategas Securities.

“Crude may very well be on the cusp of decoupling from different danger property throughout this selloff,” Byrne mentioned.

Additionally supporting crude costs, US Vitality Secretary Chris Wright mentioned on Monday that the Trump administration was ready to implement US sanctions on Iranian oil manufacturing, earlier than clawing again beneficial properties.

Oil has fallen virtually a fifth from a excessive in mid-January as Trump’s chaotic rollout of tariff hikes and push to slash federal spending darken the financial outlook within the largest producer and client of crude. Different bearish elements embrace OPEC+ plans so as to add provide and weakening demand in China.

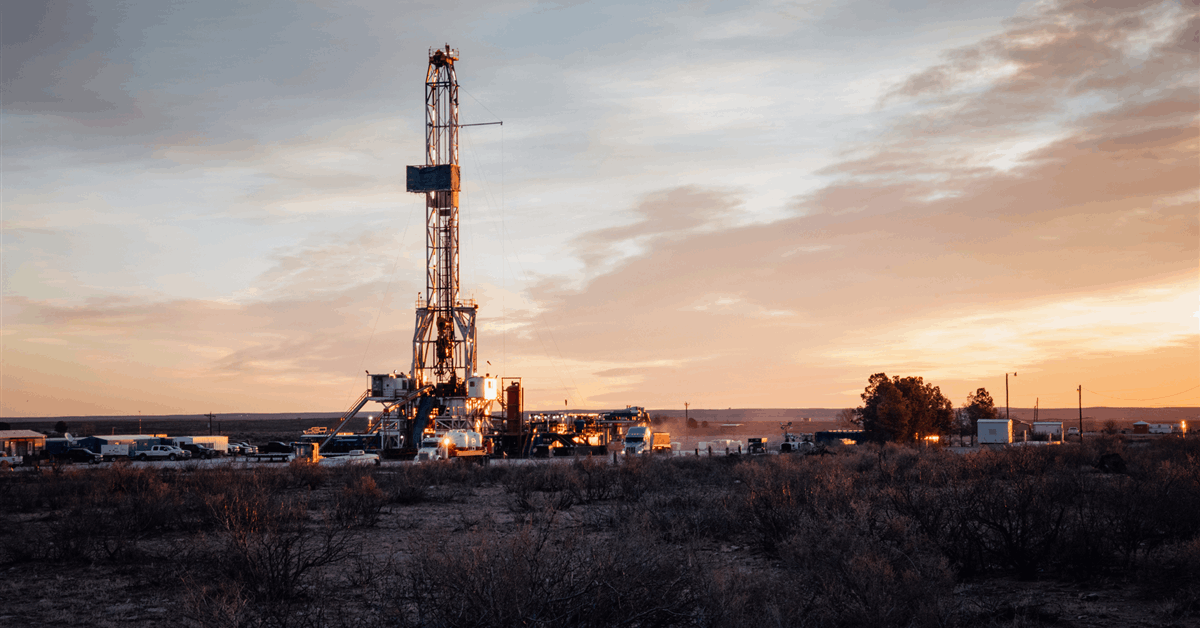

At a serious business convention in Houston, executives from a few of the world’s prime oil and fuel producers — together with Chevron Corp., Shell Plc and Saudi Aramco — provided full-throated help for President Trump’s energy-dominance agenda on the gathering.

“Given how gentle positioning is, it doesn’t take a lot to maneuver the market,” mentioned Rebecca Babin, a senior power dealer at CIBC Personal Wealth Group. “For my part, these are all noisy headlines that may gas a short-term bounce, however the actual financial information stays regarding, which can in the end hold crude underneath strain.”

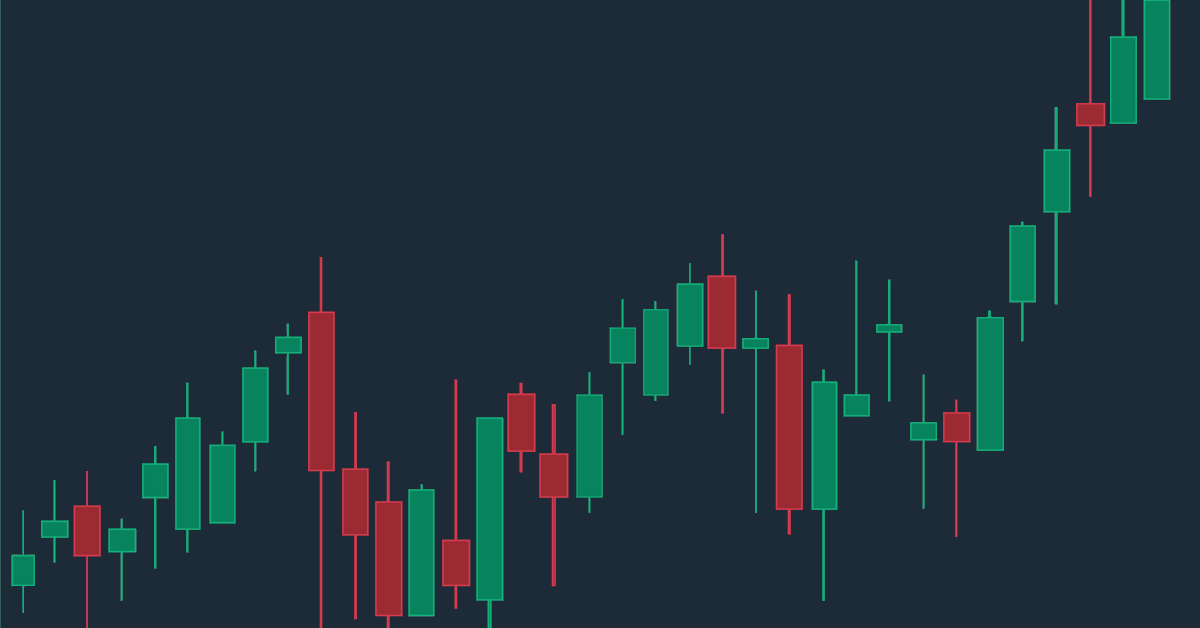

Oil Costs:

- WTI for April supply rose 0.3% to settle at $66.25 a barrel in New York.

- Brent for Could settlement climbed 0.4% to settle at $69.56 a barrel.

What do you suppose? We’d love to listen to from you, be part of the dialog on the

Rigzone Vitality Community.

The Rigzone Vitality Community is a brand new social expertise created for you and all power professionals to Converse Up about our business, share information, join with friends and business insiders and have interaction in knowledgeable group that may empower your profession in power.

MORE FROM THIS AUTHOR

Bloomberg