British oil big Shell on Thursday posted a small year-on-year drop in third-quarter revenue as a pointy decline in crude costs and decrease refining margins had been partially offset by increased gasoline gross sales.

The vitality firm reported adjusted earnings of $6 billion for the July-September interval, beating analyst expectations of $5.3 billion, in accordance with estimates compiled by LSEG.

Shell posted adjusted earnings of $6.3 billion within the second quarter and $6.2 billion within the third quarter of 2023.

Shell stated it would purchase again an additional $3.5 billion of its shares over the following three months, whereas holding its dividend unchanged at 34 cents per share.

It marks the twelfth consecutive quarter that Shell has introduced at the very least $3 billion in buybacks, Sinead Gorman, chief monetary officer at Shell, stated in a video presentation.

“This quarter we have now delivered one other robust set of outcomes regardless of a much less favorable macro surroundings,” Gorman stated.

“This was pushed by stable operational efficiency throughout our portfolio, persevering with the momentum we have constructed over latest quarters,” she added.

Internet debt got here in at $35.2 billion on the finish of the third quarter, down from $40.5 billion when in comparison with the identical interval final yr.

Shares of the London-listed agency closed 2.3% decrease.

‘A powerful place’

Shell stated third-quarter free money movement rose to $10.83 billion, up from $7.5 billion in the identical interval a yr earlier.

Money capital expenditure, in the meantime, got here in at $4.95 billion, down from $5.65 billion within the third quarter of 2023.

Maurizio Carulli, vitality analyst at wealth supervisor Quilter Cheviot, stated Shell’s third-quarter outcomes had been “significantly better than expectations at nearly each stage” and present that the corporate “is constant to ship on its technique of portfolio rationalisation, price reductions and operational enhancements.”

“Moreover, Shell is primary globally in liquified pure gasoline (LNG), a enterprise it created from scratch for the reason that seventies, with nice foresight,” Carulli stated, noting that LNG is the one phase of the oil and gasoline business anticipated to develop considerably over the next decade.

“As such, the enterprise has put itself in a powerful place to climate any volatility in commodity costs and reap the benefits of competitor struggles,” he added.

Earlier this week, British rival BP posted its weakest quarterly earnings in almost 4 years, weighed down by decrease refining margins.

BP reported underlying substitute price revenue, used as a proxy for internet revenue, of $2.3 billion for the third quarter. That beat analyst expectations — however mirrored a steep drop when in comparison with the identical interval a yr earlier.

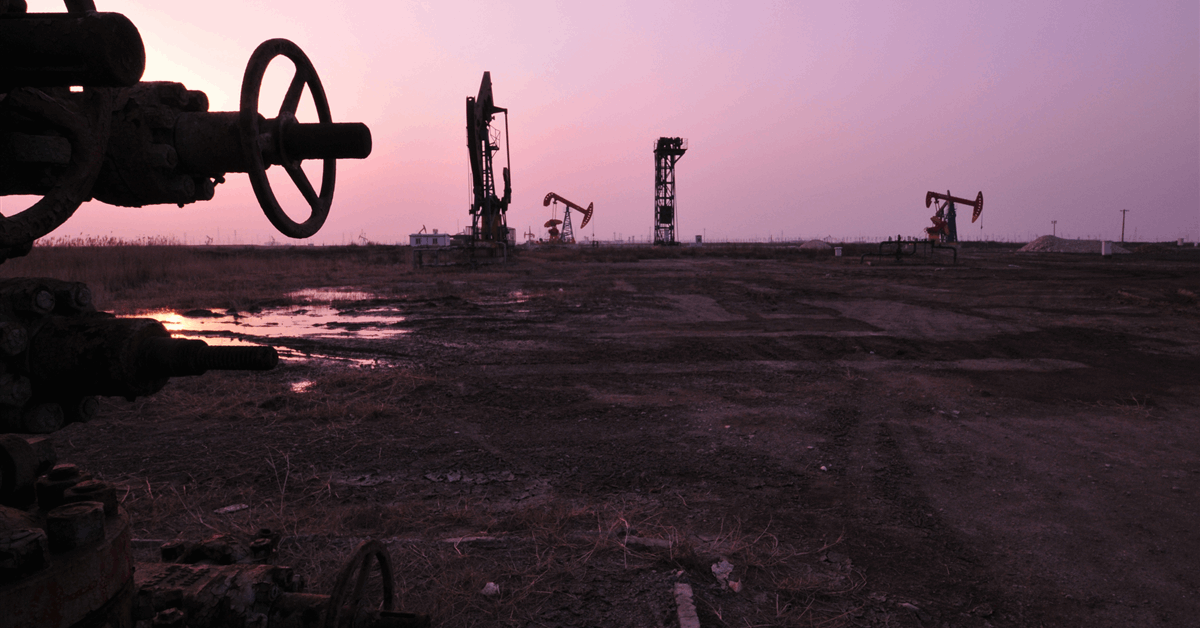

Oil costs tumbled over 17% within the third quarter amid issues over the outlook for world oil demand.

Clear vitality investments

Shell confronted criticism on Thursday from activist shareholder group Comply with This, which highlighted that the oil main’s third-quarter earnings present investments within the renewables and vitality options division fell to eight% of the agency’s general capital expenditure — down from 9% within the second quarter.

The lower in clear vitality investments comes after Shell weakened its 2030 carbon emissions discount goal in March.

Shell stated in an vitality transition technique replace on the time that it could water down its near-term carbon emissions cuts, whereas sustaining its pledge to grow to be a net-zero firm by the center of the century.

“By persevering with to wager on fossil gas enlargement, the board of Shell jeopardizes the way forward for the corporate,” Mark van Baal, founding father of Comply with This, stated in a press release.

“Fossil gas development delays the transition and will increase the danger of a carbon lock-in, which is able to make it tougher to pivot to renewables every year,” he added.

Shell on Thursday stated that the corporate underwent some “necessary developments” in its renewables and vitality options companies in latest months.

“One instance is in Norway, the place our Northern Lights three way partnership has now accomplished development. The undertaking is able to start completely storing CO2 to assist European industries decarbonize,” Gorman stated.

“Final week, we introduced the acquisition of a mixed cycle energy plant in Rhode Island, the place demand is anticipated to extend as a result of rising decarbonization efforts linked to electrification,” she added.

Shell has beforehand stated it intends to decarbonize profitably and plans to take a position $10 billion to $15 billion in low-carbon vitality options between 2023 and the top of subsequent yr.