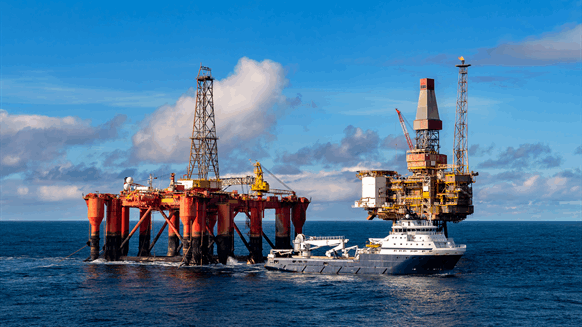

JPMorgan Chase & Co. is in talks to begin buying and selling bodily liquefied pure gasoline once more after greater than a decade on the sidelines, a transfer that strains up with Chief Government Officer Jamie Dimon’s requires a rise in home manufacturing and vitality exports.

The financial institution has held talks to safe a longterm LNG provide with a minimum of three initiatives below growth within the Gulf Coast, in response to individuals acquainted with the matter. The transfer is a part of a wider push JPMorgan has made lately to get again into buying and selling among the bodily commodities it deserted in 2014.

Discussions are underway between the financial institution and builders trying to construct a mission to liquefy and export gasoline in Louisiana known as Commonwealth LNG, Sempra Power’s enlargement of its Port Arthur web site below building in Texas and Power Switch LP’s deliberate Lake Charles LNG facility in Louisiana, the individuals mentioned, asking to not be recognized describing the confidential negotiations.

Spokespeople for JPMorgan, Sempra, and Kimmeridge Power Administration Co., which owns Commonwealth, declined to remark. A consultant for Power Switch didn’t reply to a number of requests for remark.

International demand is surging for LNG, with many countries searching for a cleaner-burning different to grease and coal as they shift towards renewable vitality. The US has emerged because the world’s largest exporter due to an plentiful provide of gasoline and the event of big terminals on the Gulf Coast to liquefy and ship the gas.

JPMorgan has no plans to bodily transfer LNG on water itself, two of the individuals mentioned. That technique would align with how different banks have dealt with bodily vitality commodities and differ from conventional buying and selling homes, which generally deal with transport themselves.

JPMorgan’s effort is the newest twist in what’s been a bumpy saga for high Wall Avenue companies’ involvement within the bodily commodity house over the previous twenty years. JPMorgan inherited Bear Stearns’s energy-trading platform when it purchased the failed financial institution in the course of the monetary disaster, and bulked up by extra acquisitions in 2009 and 2010.

By 2014, JPMorgan agreed to promote a lot of its bodily commodities arm — although the New York-based firm held on to its metals desks — as banks grappled with heightened regulatory scrutiny within the enterprise. However inside a decade, the agency was again to buying and selling within the bodily pure gasoline house.

JPMorgan has expanded its bodily pure gasoline buying and selling operation within the US since 2022 and is eying US energy, in addition to gasoline and energy in Europe, the place it just lately utilized for a pure gasoline shipper license, among the individuals mentioned.

Goldman’s Windfall

Russia’s invasion of Ukraine almost three years in the past sparked a large shift in world vitality commerce and an ensuing market frenzy. At Goldman Sachs Group Inc., lengthy a dominant power in commodities, that desk pulled in greater than $3 billion for 2022 — greater than 10 instances what it generated in 2017.

Firms within the US have accelerated building of LNG amenities lately, and JPMorgan has lengthy performed a financing position for such initiatives. Moreover, the build-out of artificial-intelligence infrastructure has sparked heightened shopper demand for commodities, JPMorgan’s world co-heads of gross sales and analysis, Claudia Jury and Scott Hamilton, mentioned in an interview earlier this yr.

In his annual letter to shareholders, Dimon wrote concerning the financial and geopolitical benefits that accompany home vitality manufacturing. That adopted earlier dispatches concerning the want for dependable, inexpensive vitality along with investments for future efforts to cut back carbon dioxide and different greenhouse gases from the ambiance.

“The export of LNG is a good financial boon for america,” Dimon wrote in April. “However most vital is the realpolitik aim: Our allied nations that want safe and inexpensive vitality sources, together with essential nations like Japan, Korea and most of our European allies, would love to have the ability to rely upon america for vitality.”

In the identical letter, he decried the Biden Administration’s pause on US LNG allowing, which successfully halted all new export initiatives from approval — calling the push to cease oil and gasoline output as “enormously naïve.”

Macquarie Group Ltd., certainly one of North America’s largest vitality merchants, additionally has a preliminary settlement for US LNG provide with the mission Texas LNG, below growth by carefully held Glenfarne Group. Macquarie Chairman Glenn Stevens echoed Dimon’s remarks on the Australian financial institution’s annual assembly in July, telling buyers that “we do assume that pure gasoline, particularly, is a vital a part of the transition path for the world.”

Generated by readers, the feedback included herein don’t mirror the views and opinions of Rigzone. All feedback are topic to editorial overview. Off-topic, inappropriate or insulting feedback will probably be eliminated.

MORE FROM THIS AUTHOR

Bloomberg