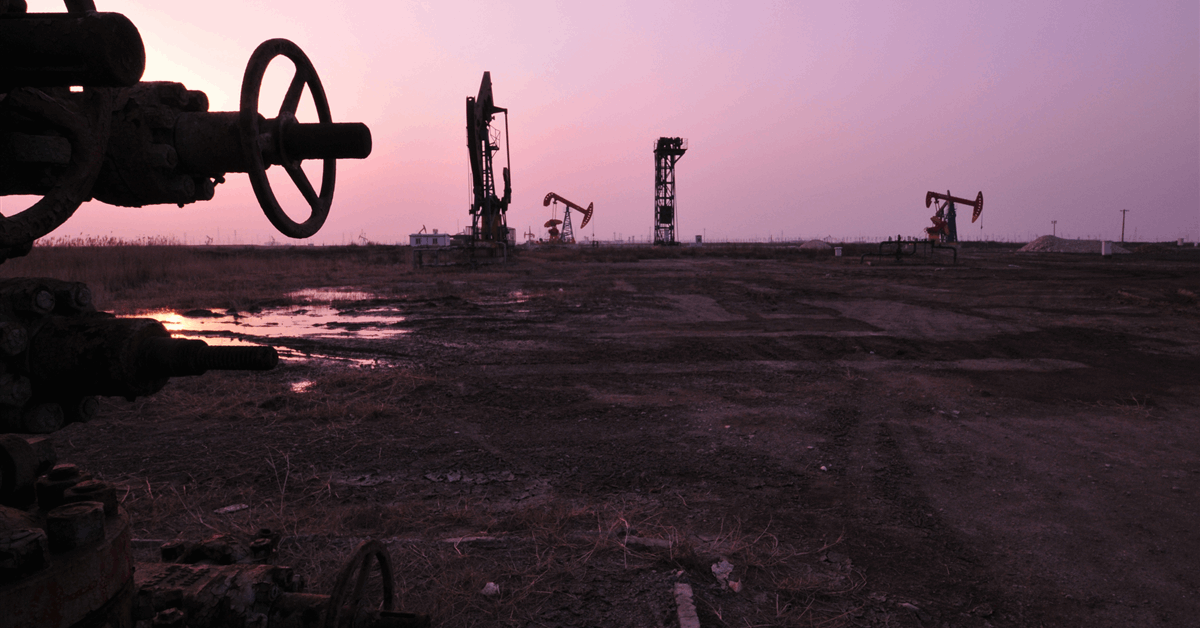

How low can the Brent oil value go in 2025?

That was the query Rigzone requested Diana Furchtgott-Roth, Director of the Heart for Local weather, Vitality, and the Surroundings at The Heritage Basis, in an unique interview lately.

Responding to the query, Furchtgott-Roth instructed Rigzone, “I don’t see the worth of oil going a lot under $55 per barrel for any size of time” however warned that “the scenario is risky and will change”.

“The value of oil can decline as a result of the provision will increase or the demand goes down. The provision might improve as America ramps up manufacturing. Demand might go down if America or the remainder of the world go right into a recession,” the Heritage Basis professional added.

Furchtgott-Roth went on to inform Rigzone that forecasting the worth of oil is determined by the macroeconomic outlook.

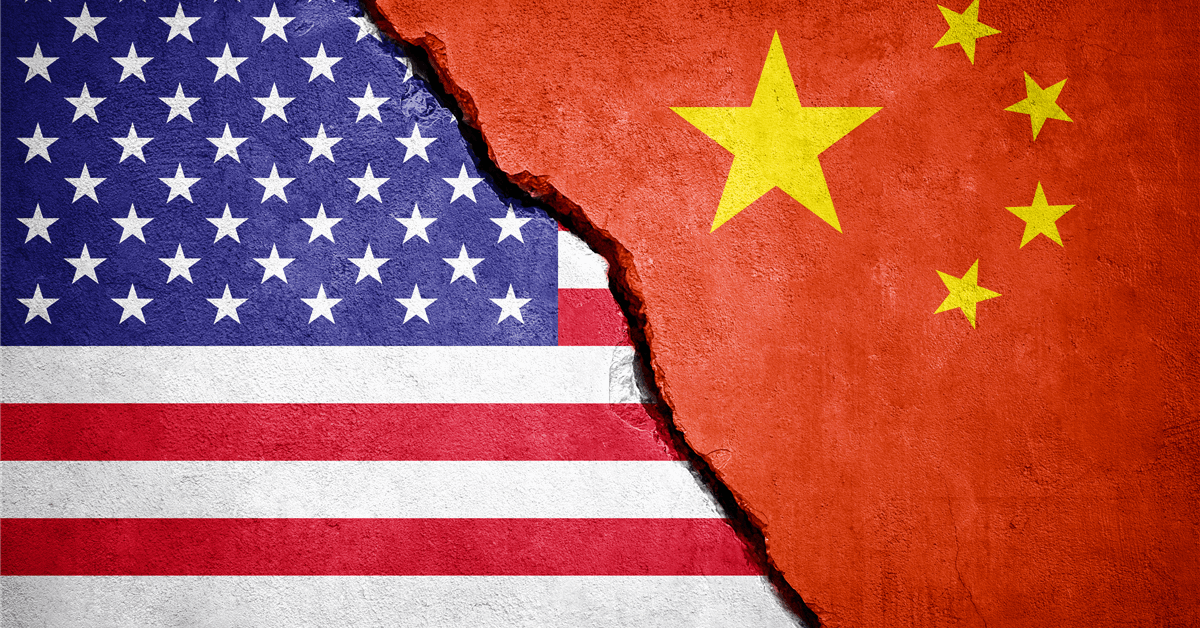

“The Blue Chip consensus predicts slower development in america this 12 months because the financial system adjusts to new tariffs, however not a recession,” Furchtgott-Roth mentioned.

“Job creation in america is wholesome and the unemployment charge is under 4.5 p.c,” the Heritage Basis professional added.

In a Skandinaviska Enskilda Banken AB (SEB) report despatched to Rigzone on April 9 by the SEB crew, Ole R. Hvalbye, a commodities analyst on the firm, highlighted that Brent “crashe[d]… to [a] 4 12 months low”.

“Since markets opened yesterday, Brent crude costs have tumbled one other $4 per barrel, falling from already depressed ranges to the present $60.9 per barrel – marking the bottom degree in over 4 years (since early February 2021),” Hvalbye famous in that report.

In a Stratas Advisors report despatched to Rigzone by the Stratas crew late Monday, the corporate identified that the worth of Brent crude ended the week at $64.59 after closing the earlier week at $66.01.

“Final week, oil costs continued to slip downward following the substantial value drop of the earlier week stemming from the announcement of extra tariffs by the Trump Administration that had been considerably higher in magnitude than anticipated, coupled with members OPEC+ agreeing on Thursday to unwind their provide cuts at a higher extent in Might than beforehand anticipated (411,000 barrels per day vs. 135,000 barrels per day),” Stratas added within the report.

The corporate went on to state that the outlook for oil demand is in flux due to the uncertainty round tariffs and the affect on financial development and oil demand.

In a report despatched to Rigzone by Customary Chartered Financial institution Commodities Analysis Head Paul Horsnell late Monday, analysts on the financial institution, together with Horsnell, mentioned web promoting by cash managers throughout the 4 essential Brent and WTI crude oil contracts reached an all-time excessive of 219.5 million barrels within the week beginning April 2.

“This was not solely extra web promoting than in any week in the course of the pandemic, it was greater than the 2 heaviest weeks of pandemic web promoting mixed,” the Customary Chartered Financial institution analysts highlighted.

“Cash managers had added 140.7 million barrels of web longs within the earlier three weeks, however they net-sold sufficient in only one week to completely cancel out that speedy accumulation of longs, plus 50 p.c extra,” they added.

The Customary Chartered Financial institution analysts went on to state within the report that different indicators additionally present a pointy transfer to the brief facet.

“Our crude oil moneymanager positioning index noticed a file week on week drop of 71.3 to -59.1, with the WTI positioning index reaching -100.0,” they famous.

“Round 80 p.c of the online promoting was because of the closing out of lengthy positions, and simply 20 p.c was the opening of brief positions,” they went on to state.

A analysis observe despatched to Rigzone by the JPM Commodities Analysis crew late Monday famous that the estimated worth of open curiosity throughout vitality markets declined by $18.6 billion week on week. The observe highlighted that this was a 3 p.c week on week drop.

“The decline was led by crude oil and petroleum merchandise which noticed $2 billion week on week of web outflows throughout all dealer varieties coupled with continued value weak point throughout the curve,” the analysis observe acknowledged.

“Our oil strategists’ have revised Brent value forecast to $66 ($62 WTI), down from $73 per barrel for 2025 and 2026 goal to $58 ($54 WTI) amid heightened commerce coverage uncertainty and shift in OPEC’s response operate,” it added.

“Open curiosity throughout pure gasoline markets declined by $8 billion week on week on the again of $2.8 billion week on week outflows and because the international pure gasoline value declined additional,” it continued.

Rigzone has contacted the White Home, the U.S. Division of Vitality, and the American Petroleum Institute for touch upon Furchtgott-Roth’s statements. Rigzone has additionally contacted the White Home and OPEC for touch upon the Stratas Advisors report and the JPM Commodities Analysis crew observe. On the time of writing, not one of the above have responded to Rigzone.

In a report despatched to Rigzone by the Goldman Sachs crew on Monday, Goldman Sachs analysts revealed that they see the Brent oil value falling to beneath $40 per barrel beneath one state of affairs.

Goldman Sachs’ report outlined that the corporate’s base state of affairs sees the Brent spot value averaging $66 per barrel in 2025. The report additionally outlined that the corporate’s base case sees the Brent Futures value averaging $63 per barrel this 12 months.

In accordance with a BMI report despatched to Rigzone by the Fitch Group on Monday, BMI sees the Brent oil value averaging $68 per barrel in 2025.

In its newest brief time period vitality outlook, which was launched on April 10, the U.S. Vitality Info Administration projected that the Brent spot value will common $67.87 per barrel this 12 months.

A Customary Chartered Financial institution report despatched to Rigzone by Horsnell on April 8 confirmed that Customary Chartered anticipated the ICE Brent close by future crude oil value to common $77 per barrel in 2025.

To contact the creator, e-mail andreas.exarheas@rigzone.com