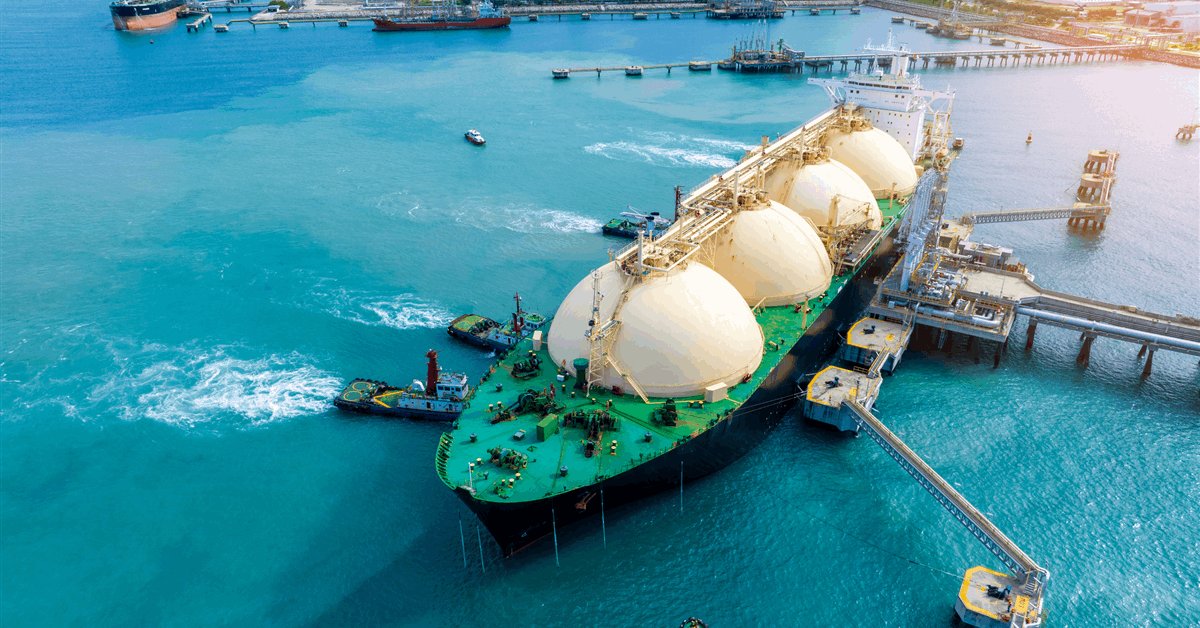

Cheniere Power Inc. has produced the primary liquefied pure gasoline (LNG) cargo from a undertaking increasing the Corpus Christi LNG (CCL) terminal within the namesake Texan metropolis.

CCL Stage 3 has seven midscale trains with an anticipated manufacturing capability of over 10 million metric tons each year (MMtpa), elevating CCL’s output capability to over 25 MMtpa from 10 trains.

“First LNG manufacturing from the primary prepare of the CCL Stage 3 Mission was achieved in December 2024, and the primary cargo of LNG was produced in February 2025”, Houston, Texas-based Cheniere stated in its quarterly report.

It plans to construct two extra mid-scale trains adjoining to the Stage 3 undertaking for an additional capability addition of about 3 MMtpa. “In June 2024, we acquired a optimistic Environmental Evaluation from the FERC and anticipate receiving all remaining crucial regulatory approvals for the undertaking in 2025”, the report stated.

Citing new capability unlocked from the enlargement, Cheniere expects to surpass final 12 months’s earnings. Consolidated adjusted EBITDA steering for 2025 is $6.5 billion-$7 billion, in comparison with the precise 2024 determine of $6.2 billion. Distributable money movement this 12 months is anticipated to be $4.1 billion-$4.6 billion, in comparison with the precise 2024 determine of $3.7 billion.

“We count on 2025 to be one other report 12 months for LNG manufacturing as Stage 3 trains are accomplished, and we sit up for delivering monetary outcomes inside these ranges and additional enhancing the long-term worth proposition of Cheniere”, commented president and chief govt Jack Fusco. Final 12 months Cheniere exported a report 646 LNG cargoes, or 2.33 trillion British thermal models.

Cheniere posted $977 million in web revenue for the fourth quarter (This autumn) of 2024 and $3.25 billion for the total 12 months. The figures have been down 29 % and 67 % by year-ago comparisons, respectively.

On a diluted foundation, This autumn earnings per share landed at $4.33, beating the Zacks Consensus Estimate of $2.69 per share.

“The decreases have been primarily attributable to roughly $599 million and $6.7 billion of unfavorable variances associated to adjustments in honest worth of our spinoff devices (earlier than tax and non-controlling pursuits) for the three and twelve months ended December 31, 2024, respectively, as in comparison with the corresponding 2023 durations”, Cheniere stated.

“The decreases have been partially offset by decrease provisions for earnings tax, in addition to decrease web earnings attributable to non-controlling pursuits throughout each durations”.

Consolidated adjusted EBITDA dropped year-on-year by about $73 million for This autumn and $2.6 billion for 2024. “The decreases have been primarily because of the moderation of worldwide gasoline costs, leading to decrease whole margins per MMBtu [million British thermal units] of LNG delivered, in addition to the next proportion of our LNG being offered beneath long-term contracts throughout each 2024 durations as in comparison with the corresponding 2023 durations”.

Income totaled $4.44 billion for This autumn, down eight % year-over-year, and $15.7 billion for 2024, down 23 % in opposition to 2023.

Cheniere declared a dividend of $0.5 per share for This autumn, sustaining the earlier fee.

It ended the 12 months with $2.64 billion in money and money equivalents, plus $552 million in restricted money and money equivalents. Present belongings totaled $4.8 billion.

Cheniere owed $4.44 billion in present liabilities as of year-end, together with $351 million in present debt.

To contact the creator, electronic mail jov.onsat@rigzone.com

What do you assume? We’d love to listen to from you, be part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all vitality professionals to Communicate Up about our business, share data, join with friends and business insiders and have interaction in an expert neighborhood that may empower your profession in vitality.