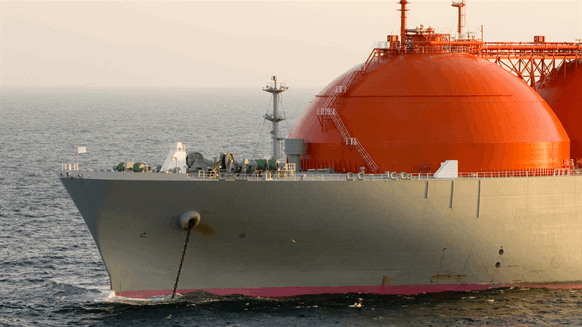

MidOcean Vitality LLC has raised its possession in South America’s solely export facility for liquefied pure fuel (LNG) to 35 p.c following an acquisition from Hunt Oil Co., the businesses stated.

The 15 p.c stake buy by the LNG arm of EIG International Vitality Companions was funded by Saudi Arabian Oil Co. (Aramco) as an investor in MidOcean Vitality. The state-owned oil big will get an oblique stake in Peru LNG of 17.2 p.c and a rise to its stake in MidOcean Vitality to 49 p.c post-transaction, based on the official assertion on the settlement between MidOcean Vitality and Hunt on September 16.

Peru LNG, situated on a 521-hectare website on the Pacific coast 170 kilometers (105.6 miles) south of Lima, has a processing capability of 4.56 million metric tons a 12 months and a 408-kilometer (253.5 miles) pipeline with a capability of 1,290 million cubic ft per day (MMcfd). The complicated additionally has two 130,000 cubic-meter (4.6 cubic ft) storage tanks, a 1.4-kilometer (0.9 miles) marine terminal and a truck loading facility with a capability of 19.2 MMcfd, based on MidOcean Vitality.

MidOcean Vitality acquired its preliminary 20 p.c stake in Peru LNG about seven months in the past in a transaction with SK earthon Co. Ltd.

Dallas, Texas-based Hunt stays the operator with a 35 p.c possession. Shell PLC has a 20 p.c stake, whereas the remaining 10 p.c is held by Marubeni Corp.

“Our perception within the long-term fundamentals of the LNG market and within the power of PLNG’s distinctive place as the one LNG export facility in South America stays steadfast”, MidOcean Vitality chief govt De la Rey Venter stated.

“We’re targeted on positioning the PLNG undertaking for the longer term, and the chance to herald MidOcean as a companion was an awesome strategic match to make that occur”, Hunt chief govt Mark Gunnin stated.

Peru LNG is the second LNG undertaking entered into by MidOcean Vitality following Aramco’s stake acquisition within the portfolio firm managed by Washington-based EIG. Aramco’s $500 million buy of a stake in MidOcean Vitality, accomplished within the first quarter of 2024 based on Aramco’s quarterly report Might 7, marked Aramco’s “first worldwide funding in LNG”.

“MidOcean Vitality is well-equipped to capitalize on rising LNG demand, and this strategic partnership displays our willingness to work with main worldwide gamers to establish and unlock new alternatives at a worldwide stage”, Aramco upstream president Nasir Ok. Al-Naimi stated in a press launch September 28, 2023, saying the settlement with MidOcean Vitality.

On March 28, 2024, MidOcean Vitality stated it had accomplished the acquisition of Tokyo Gasoline Co. Ltd.’s stakes in Australia’s Gorgon LNG, Ichthys LNG, Pluto LNG and Queensland Curtis LNG for $2.15 billion.

“The acquisition marks the launch of MidOcean’s technique to construct a high-quality, diversified, international ‘pure play’ built-in LNG firm and leverages EIG’s in depth investing expertise within the international LNG sector, underpinned by a number of billion {dollars} of commitments to a number of LNG tasks over the previous 20 years, most not too long ago together with the acquisition of a controlling curiosity in GNL Quintero S.A., the most important LNG regasification terminal in Chile”, MidOcean Vitality stated in a press launch October 7, 2022, saying the cope with Tokyo Gasoline.

After Aramco, Mitsubishi Corp. additionally invested in MidOcean Vitality, as introduced April 1, 2024.

To contact the creator, electronic mail jov.onsat@rigzone.com

What do you suppose? We’d love to listen to from you, be part of the dialog on the

Rigzone Vitality Community.

The Rigzone Vitality Community is a brand new social expertise created for you and all vitality professionals to Converse Up about our trade, share data, join with friends and trade insiders and interact in an expert neighborhood that may empower your profession in vitality.