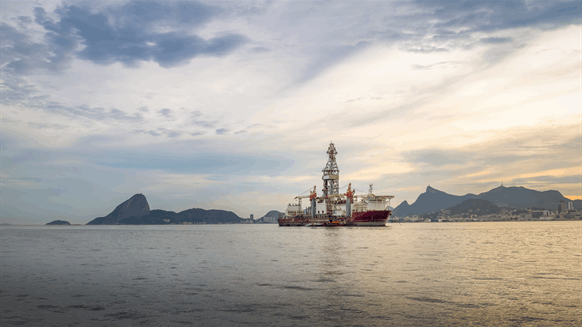

CNOOC Ltd. has entered into 4 new concessions in Brazil, increasing its footprint within the Santos basin.

The state-backed Chinese language exploration and manufacturing firm, by means of CNOOC Petroleum Brasil Ltd., acquired a 100% working stake in block SM1813 within the offshore Santos basin. Moreover CNOOC secured a 20 % non-operating curiosity every in blocks PM1737, PM1739 and PM1797 within the offshore portion of the Pelotas basin.

The companions within the Pelotas licenses are Petróleo Brasileiro SA (Petrobras), which owns a 50 % working stake in every block, and Shell PLC, which holds the remaining 30 %.

The Nationwide Company of Petroleum, Pure Fuel and Biofuels (ANP) awarded the 4 leases underneath the fourth Everlasting Concession Supply Cycle, CNOOC stated Thursday in a press launch on its web site.

State-run Petrobras had already introduced the Pelotas concessions Monday, saying, “The signing of those contracts… strengthens Petrobras’ place as the principle operator of oil fields positioned in deep and ultra-deep waters, potentializing the recomposition of reserves for the long run”. Petrobras has now received a complete of 29 Pelotas concessions underneath the fourth Everlasting Concession Supply Cycle.

Oil and gasoline concessionaires in Brazil assume the dangers of investing, together with failed explorations. Within the bidding spherical an organization or consortium should suggest a bonus signature fee and a minimal exploratory program, in line with the ANP.

Within the South American nation, CNOOC is an investor within the first production-sharing contract, involving the Libra block within the Santos basin. It was awarded 2013 to a consortium of CNOOC, Petrobras, Shell, Whole and China Nationwide Petroleum Corp. CNOOC holds a ten % stake in Libra, which incorporates the Mero oilfield.

Within the four-phase Mero venture, two phases have achieved manufacturing. Put onstream 2022, Mero 1 has averaged 14,000 barrels of oil equal per day (boepd), in line with CNOOC. Mero 2 got here on-line earlier this 12 months. Mero 3 is predicted to start out manufacturing additionally this 12 months, whereas Mero 4 has to date reached a optimistic funding resolution. Every section has a capability of 180,000 bpd.

CNOOC additionally participates within the Búzios block, additionally within the Santos basin, with a 7.34 % stake. Búzios is deliberate to have 11 manufacturing models. The primary 4 models to be put into manufacturing have an combination each day output of about 43,000 boe, whereas Búzios 5 simply started manufacturing final 12 months and is predicted to have a each day common of 150,000 barrels of oil and 6 million cubic meters (211.9 million cubic ft) of pure gasoline.

CNOOC additionally owns a 100% stake within the ESM592 block offshore Brazil, 30 % within the Pau Brasil block and 20 % within the ACF Oeste block.

To contact the writer, e-mail jov.onsat@rigzone.com

What do you assume? We’d love to listen to from you, be part of the dialog on the

Rigzone Vitality Community.

The Rigzone Vitality Community is a brand new social expertise created for you and all power professionals to Communicate Up about our business, share data, join with friends and business insiders and have interaction in knowledgeable neighborhood that may empower your profession in power.