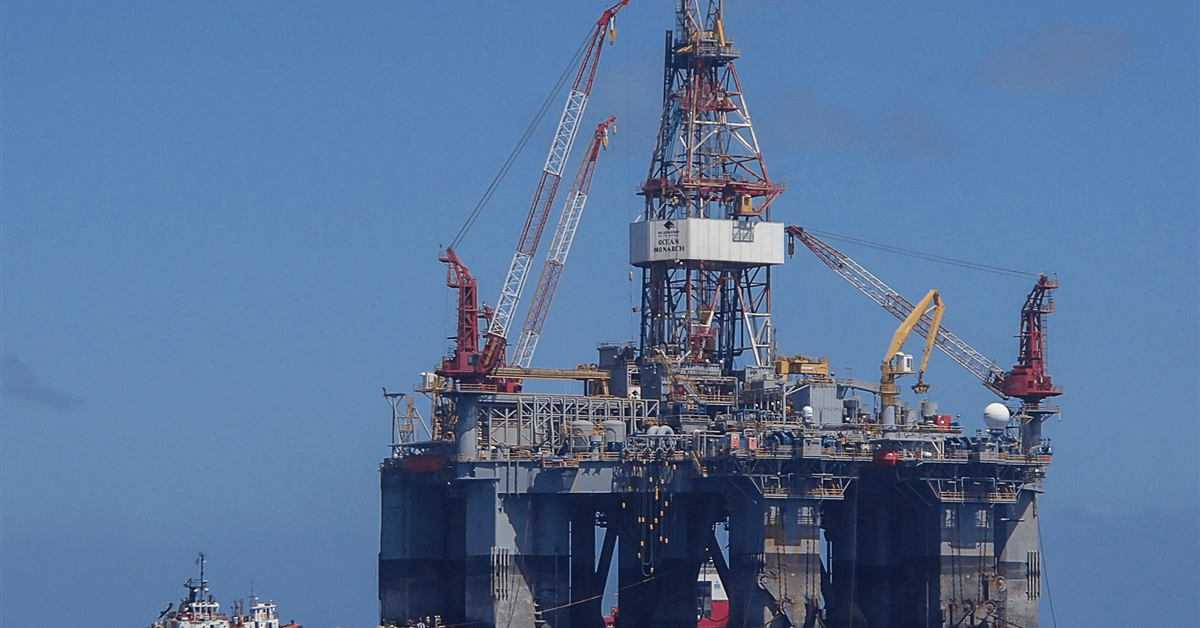

BP Plc expects its web debt to have risen within the third quarter as a consequence of decrease refining margins and modifications to the timing of asset gross sales.

The London-based firm’s oil-products buying and selling was weak within the interval, and decrease margins from processing crude will hit earnings by $400 million to $600 million, in accordance with an announcement on Friday. General manufacturing was little modified in contrast with the prior quarter.

The assertion from BP provides to the weaker image for the oil trade within the third quarter, with each Exxon Mobil Corp. and Shell Plc flagging the potential for decrease earnings from producing and refining crude.

The interval was dominated by doubts concerning the power of demand from China and considerations that the market would return to surplus if OPEC+ went forward with plans to revive idle provide — a transfer the group was finally pressured to delay by two months. Brent crude slumped by 17% within the third quarter, though it has since rebounded because of the battle within the Center East.

BP additionally anticipates the “rephasing” of about $1 billion of divestment proceeds into the fourth quarter, out of a complete of $2 billion to $3 billion for the second half, in accordance with the assertion. The corporate’s web debt has been trending decrease in recent times – from $40 billion in 2020 to about $23 billion on the finish of the second quarter — as excessive power costs boosted revenue.

Generated by readers, the feedback included herein don’t replicate the views and opinions of Rigzone. All feedback are topic to editorial overview. Off-topic, inappropriate or insulting feedback will likely be eliminated.

MORE FROM THIS AUTHOR

Bloomberg