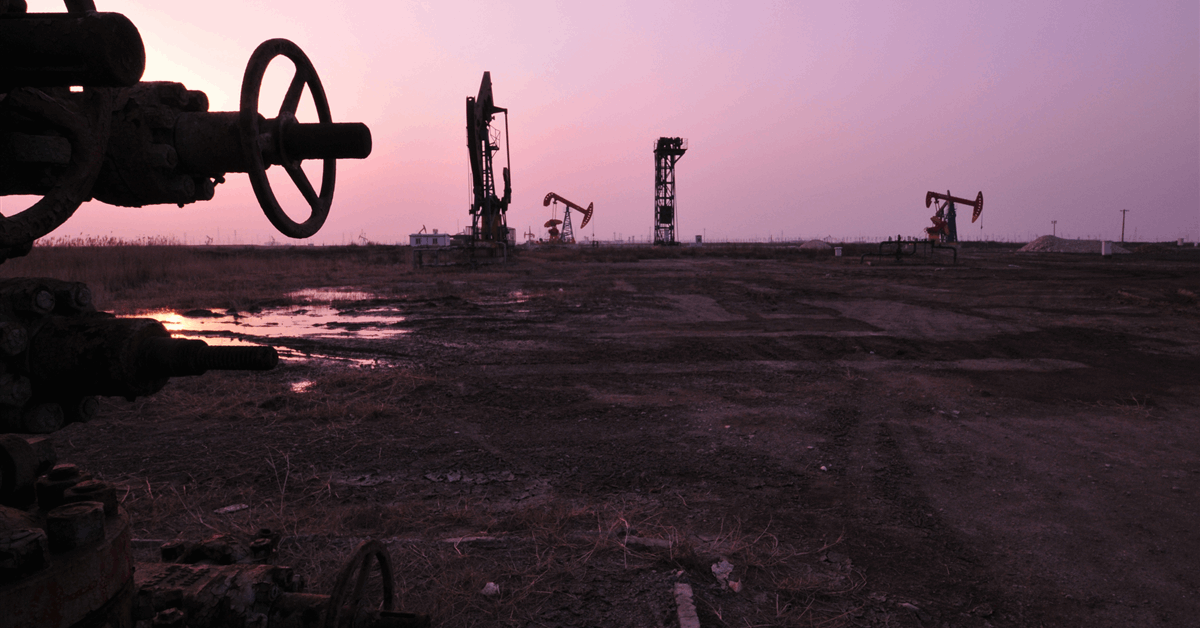

In a brand new BMI report despatched to Rigzone by the Fitch Group, analysts at BMI, a Fitch Options firm, flagged an “upstream gasoline dilemma” for the Philippines.

The analysts famous within the report that the Philippines’ long-term outlook on gasoline manufacturing hinges on the success of drilling actions on the Malampaya gasoline subject. The added that the invention of the sector reworked the Philippines’ vitality sector however warned that the nation now faces declining manufacturing and growing LNG import dependence.

“Lengthy-term forecasts predict gasoline manufacturing will drop from 2.13 billion cubic meters (bcm) in 2024 to 0.94 bcm in 2033, a staggering 55.87 p.c discount,” the BMI analysts stated within the report.

The analysts highlighted within the report that, on the finish of 2022, Prime Infrastructure Capital acquired 100% possession of the Malampaya gasoline subject from Shell. They famous that the extension of the Service Contract 38 (SC 38) “rises hopes for continued gasoline manufacturing” however stated “it stays to be seen whether or not deliberate drilling efforts would end in further gasoline discoveries”.

“Dutch offshore contractor Allseas has secured a $180 million contract from Prime Power Sources Growth, a subsidiary of Prime Infrastructure Capital Inc., to put in important pipeline and umbilical infrastructure for the Malampaya pure gasoline subject,” the analysts identified within the report.

“That is a part of Venture Sinagtala, the Malampaya life extension initiative aimed toward enhancing the nation’s vitality safety. Prime Power intends to speculate as much as $800 million on this initiative, which entails drilling two deepwater growth wells within the Camago and Malampaya East fields and a 3rd exploratory effectively named Bagong Pagasa,” they added.

“The undertaking’s purpose is to increase the gasoline subject’s operational life till 2026, with first gasoline anticipated that 12 months,” they continued.

Gasoline Consumption

The BMI analysts warned within the report that pure gasoline consumption within the Philippines is predicted to rise from 2.85 bcm in 2022 to 12.63 bcm in 2033, “marking a 343.51 p.c enhance”.

“This robust demand development will likely be fueled primarily by the enlargement of gas-fired energy era capability,” the analysts stated.

“Regardless of strong authorities assist, gasoline demand development within the Philippines stays restricted throughout numerous sectors. At present, solely the ability sector consumes pure gasoline, as industrial use dropped to zero in 2022 following the closure of Shell’s Batangas refinery,” they added.

“The Division of Power (DOE) goals for a 1.5 p.c enhance in pure gasoline consumption from the transport and industrial sectors by 2040. Nonetheless, development within the transport sector is unlikely within the quick to medium time period, as the federal government favors electrical automobiles over compressed pure gasoline (CNG) automobiles,” they continued.

Within the report, the BMI analysts famous that, till 2022, the Philippines was self-sufficient in pure gasoline, however added that, from 2023, the nation has proven a reliance on LNG imports, “forecast to rise from 3.10 bcm in 2023 to 11.68 bcm in 2033”.

“The LNG import development outlook for the Philippines is bullish, however imports could also be hampered by strengthening spot LNG costs,” the analysts warned.

“Additional will increase in costs will decelerate LNG imports and vice versa. At present, not one of the potential LNG customers has signed long-term sale and buy agreements with LNG producers and merchants, leaving them completely uncovered to the spot LNG market,” they added.

Profound Implications

The BMI analysts acknowledged within the report that the implications of the declining manufacturing from the Malampaya gasoline subject and the growing reliance on LNG imports are profound for the Philippines’ vitality sector.

“With comparatively low pure gasoline manufacturing, the Philippines could face challenges in reaching vitality safety and should must depend on imports to satisfy its vitality calls for,” the analysts stated within the report.

“This dependence on imports can expose the nation to world market fluctuations and provide chain disruptions,” they added.

The analysts additionally famous within the report that the volatility of LNG costs on account of geopolitical elements provides one other layer of uncertainty for buyers and business stakeholders.

“To deal with these points, the Philippines Division of Power goals to reinforce its downstream pure gasoline restoration in addition to enhance LNG import infrastructure, as guided by DOE Division Round (DC) 2017-11-0012,” the analysts highlighted.

“Moreover, useful resource exploration, together with the analysis of potential sedimentary basins and the lifting of the moratorium on West Philippine Sea useful resource exploration, may doubtlessly enhance recoverable reserves considerably,” they added.

EI Knowledge

In keeping with the Power Institute’s 2024 statistical evaluation of world vitality, the Philippines’ pure gasoline consumption totaled 3.2 bcm in 2023.

That determine marked 4.0 p.c 12 months on 12 months enhance and 0.1 p.c of world pure gasoline consumption final 12 months, the evaluation outlined. From 2013 to 2023, Philippines pure gasoline consumption has dropped by a median of 0.5 p.c per 12 months, the evaluation confirmed.

The highest three nations by way of pure gasoline consumption in 2023 have been the U.S., with 886.5 bcm, Russia, with 453.4 bcm, and China, with 404.8 bcm, in keeping with the evaluation.

The newest EI evaluation didn’t record the Philippines by title below an Asia Pacific subcategory for gasoline output. It included an ‘different Asia Pacific’ manufacturing determine, which totaled 22.0 bcm in 2023. The listed nation below the Asia Pacific subcategory with the bottom pure gasoline output determine was Vietnam, with 7.2 bcm in 2023.

The highest three international locations by way of pure gasoline manufacturing final 12 months have been the U.S., with 1035.3 bcm, Russia, with 586.4 bcm, and Iran, with 251.7 bcm, the evaluation confirmed.

To contact the writer, e-mail andreas.exarheas@rigzone.com