Saudi Aramco is about to produce the bottom quantity of oil to China in a number of months, even because the OPEC+ cartel gears as much as increase output.

The state-owned Saudi Arabian main will ship 34 million to 36 million barrels of April-loading crude to prospects in China, the world’s largest importer, in keeping with information compiled by Bloomberg. That compares with 41 million for March, and a determine under 36 million can be the smallest since at the least the primary half of final 12 months.

Aramco’s month-to-month gross sales to Asia, and particularly to China, are an necessary supply of provide for a lot of refiners throughout the area. The amount of the shipments, that are bought solely by way of long-term contracts, determines how a lot crude these processors might want to purchase on the spot market from producers together with Iraq, the United Arab Emirates and West Africa.

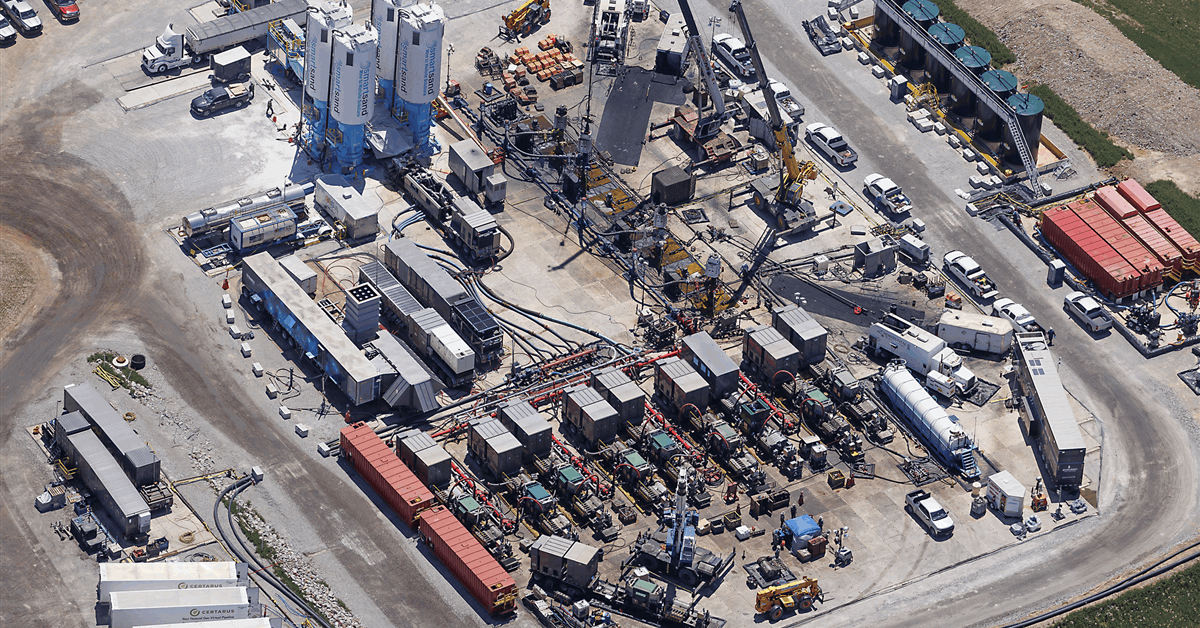

The most recent official promoting costs supplied by Aramco have been decrease than anticipated in a Bloomberg survey. At current, it’s unclear if the drop in gross sales is because of decrease requests for cargoes from Chinese language prospects, or a discount in provide from the dominion.

The decline within the Saudi volumes comes because the Group of the Petroleum Exporting International locations and its allies goal to revive output from subsequent month, kicking off the primary of what might be a protracted sequence of modest provide will increase. That transfer – coupled with wider considerations in regards to the potential influence on vitality demand from the US-led commerce struggle – have weighed on crude futures.

Three different refiners outdoors of China mentioned they acquired all the crude that they’d requested. Aramco’s press workplace didn’t reply to an e mail looking for remark.

What do you assume? We’d love to listen to from you, be part of the dialog on the

Rigzone Vitality Community.

The Rigzone Vitality Community is a brand new social expertise created for you and all vitality professionals to Converse Up about our business, share information, join with friends and business insiders and have interaction in knowledgeable neighborhood that can empower your profession in vitality.

MORE FROM THIS AUTHOR

Bloomberg