A brutal chilly snap, on high of issues that the warm-up after it may not be as heat as beforehand projected, is giving the U.S. pure fuel market a lift, Phil Flynn, a senior market analyst on the PRICE Futures Group, advised Rigzone in an unique interview when requested why the U.S. pure fuel worth is rising at present.

“On the manufacturing aspect, we’ve seen it rise and that could be a little bit of a priority for the bulls,” Flynn stated, including that, “on the flip aspect, this chilly entrance shuts in some manufacturing which will offset a few of these positive factors”.

Flynn advised Rigzone that the demand for pure fuel “goes to exceed information” and stated “that ought to hold the market considerably supportive”. He famous that the bears “proceed to level to the potential for … [a] glut due to the will increase that we’ve seen in pure fuel manufacturing throughout the US”.

When Josh Garcia, a senior fuel analyst at Vitality Points, was requested why the U.S. pure fuel worth is rising at present in a separate unique interview, he advised Rigzone that “climate has shifted colder day on day (d/d), bringing the 15-day forecast nearer to the ten 12 months regular”.

“Our climate mannequin added 20 HDDs (heating diploma days) d/d over the following two weeks, however some preliminary climate mannequin runs reportedly added 66 HDDs d/d,” he added.

Garcia acknowledged that “Decrease 48 manufacturing can be lagging barely, realizing at 103.4 billion cubic ft per day (bcfpd) at present, down from prints round 104.0 bcfpd earlier in December”.

Frederick J. Lawrence, the ex-Unbiased Petroleum Affiliation of America (IPAA) Chief Economist, advised Rigzone in one other unique interview that pure fuel costs this week are reacting to a swath of colder climate within the Midwest as well as to continued indicators of strong pure fuel demand going into 2025.

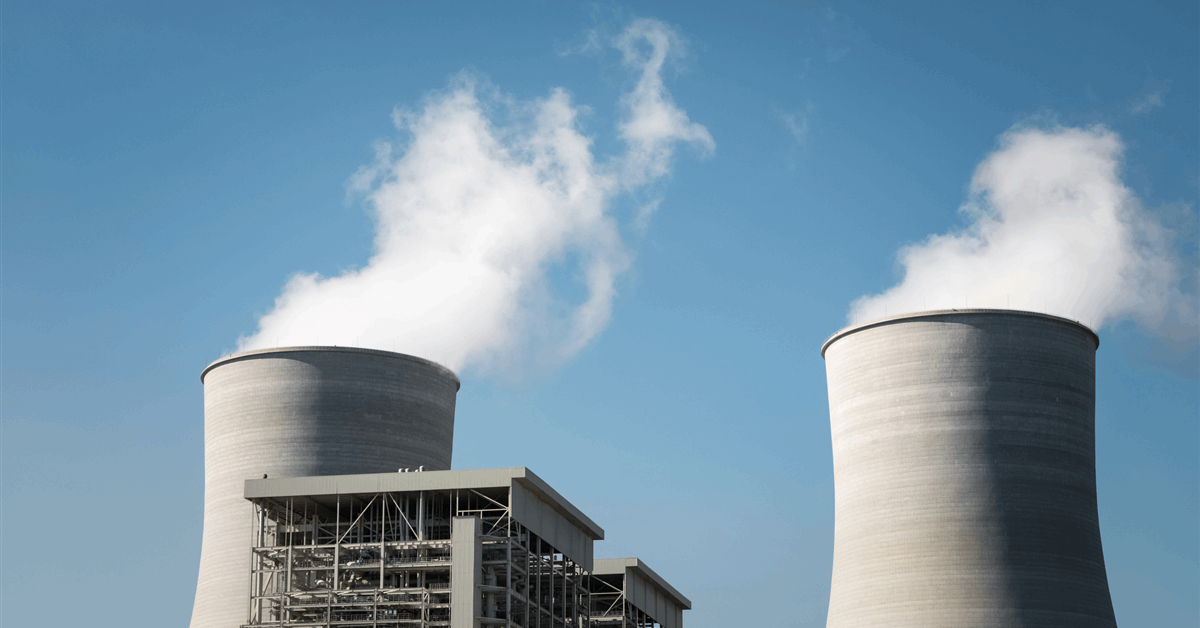

“The December EIA STEO included sturdy language for pure fuel demand; ‘we forecast the U.S. benchmark Henry Hub spot worth will improve from a mean of simply over $2.00 per million British thermal items (MMBtu) in November to a mean of about $3.00/MMBtu for the remainder of the winter heating season’,” Lawrence highlighted to Rigzone.

“A main driver of pure fuel demand consists of U.S. electrical energy consumption, which the EIA expects to achieve all-time highs this 12 months after which once more in 2025,” he added.

“Excessive electrical energy consumption joins a pattern of regular and powerful LNG exports which collectively will empower pure fuel costs into the brand new 12 months,” he continued.

Lawrence acknowledged that the climate driver additionally stays vital with colder climate programs within the Midwest, Ohio Valley, and East, along with low temperatures in North Texas, the South, and Southeast.

The ex-IPAA Chief Economist identified that pure fuel storage stays above the five-year common.

Ole R. Hvalbye, Commodities Analyst at Skandinaviska Enskilda Banken AB (SEB), highlighted to Rigzone in one other unique interview at present that the Henry Hub worth “rallied again to ranges seen in the course of the opening on Monday this week”.

Hvalbye stated this transfer has been primarily supported by stronger than regular demand.

“Pure fuel demand within the Decrease 48 states rebounded to 104.8 bcfpd at present after briefly dipping to near-normal ranges, in response to Bloomberg information,” he stated.

“Whereas near-term climate forecasts stay blended, the week is predicted to finish with colder situations earlier than temperatures rise above regular throughout the U.S. subsequent week, ultimately normalizing on the East Coast throughout the 12-day vary,” he added.

“Additionally, in response to Bloomberg information, U.S. home pure fuel manufacturing is estimated at 104.6 bcfpd at present, barely under final week’s common of 104.9 bcfpd,” he continued.

In a separate unique interview on Wednesday, Artwork Hogan, Chief Market Strategist at B. Riley Wealth, highlighted to Rigzone that pure fuel was down yesterday “however held above key assist of $3.00”, which he stated “introduced in patrons at present”.

“The following resistance to be careful for is the $3.40 stage, which has been an space of latest resistance,” he warned.

“If we are able to break above the $3.40 stage, then it’s doable that pure fuel heads to the $4 stage over the following a number of weeks,” he added.

“On the elemental aspect, we have now settled into extra seasonally applicable colder climate throughout many of the U.S., which ought to decide up demand,” Hogan went on to state.

To contact the creator, e-mail andreas.exarheas@rigzone.com