Shale fracker Liberty Vitality Inc. posted its worst earnings in three years amid plunging oil costs and mounting considerations about vitality demand.

Adjusted first-quarter revenue fell to 4 cents a share, in accordance with an announcement Wednesday, matching the typical estimate amongst analysts. Gross sales and capital spending each got here in higher than anticipated, prompting the shares to rise greater than 9% earlier than the beginning of standard buying and selling in New York on Thursday.

Present ranges of fracking exercise counsel US oil output will maintain regular, “mitigating the opportunity of steep declines skilled by the service trade in previous cycles,” the corporate mentioned. In the meantime, main shale driller Diamondback Vitality Inc. mentioned Wednesday that it’s “actively reviewing its working plan” for the remainder of the 12 months given market volatility, in accordance with a separate assertion.

“Whereas the present tumult in commodity costs will not be instantly driving modifications in North American exercise, we anticipate oil producers are evaluating a variety of situations in anticipation of oil value stress,” Liberty mentioned.

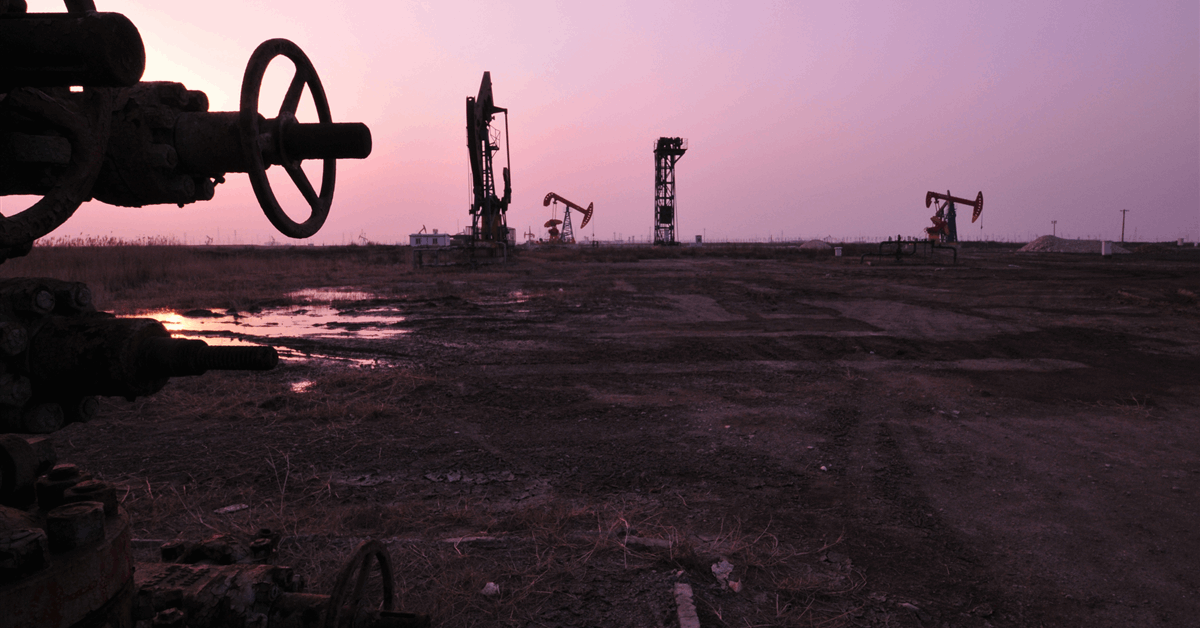

Liberty’s broad footprint throughout North American shale gives it a novel scope of imaginative and prescient for home oil-production traits. The Denver-based oilfield contractor has tumbled roughly 40% this 12 months as US President Donald Trump’s commerce struggle punished crude costs and tarnished the outlook for near-term fossil-fuel demand.

Liberty is the primary main US-based oil-service firm to put up quarterly outcomes, with rival Halliburton Co. set to comply with Tuesday morning.

Generated by readers, the feedback included herein don’t mirror the views and opinions of Rigzone. All feedback are topic to editorial overview. Off-topic, inappropriate or insulting feedback will probably be eliminated.

MORE FROM THIS AUTHOR

Bloomberg