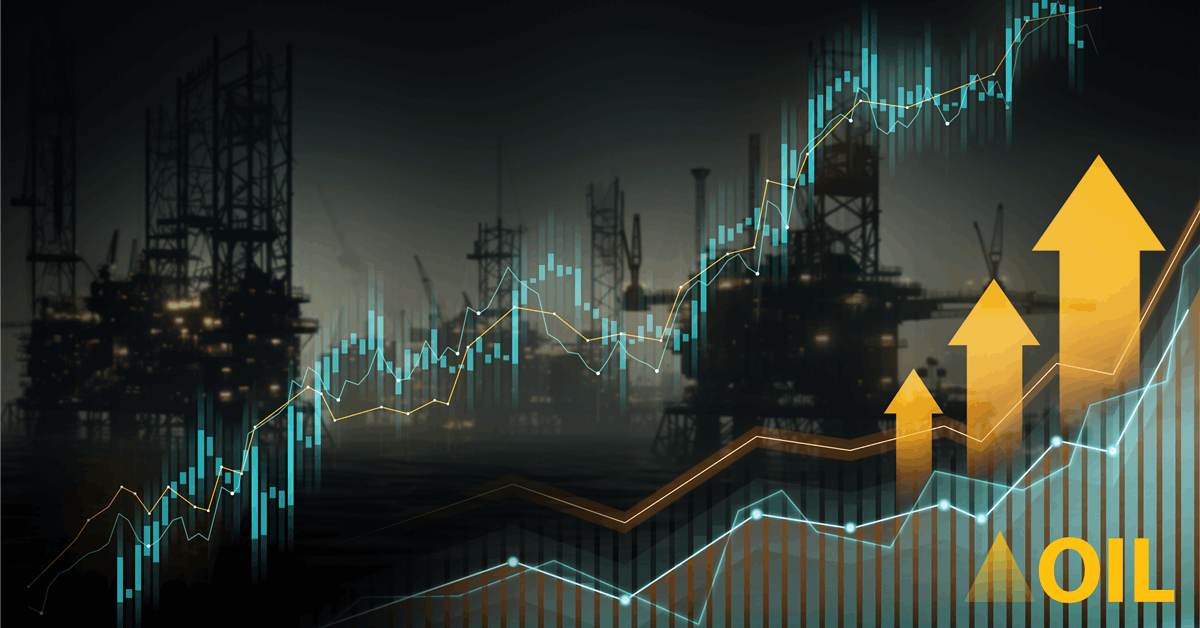

Oil rose for a second day after the Trump administration ratcheted up stress on Iran’s vitality exports, whereas talks between the US and a handful of key commerce companions stirred optimism that agreements on commerce could be reached.

West Texas Intermediate surged 3.5% to settle close to $65 a barrel, marking the biggest two-day improve since early January. President Donald Trump mentioned he’s assured a commerce take care of the European Union might be achieved, and negotiations between the US and Japan bolstered expectations that offers could be struck to keep away from the worst results of tariffs.

Futures had been additionally propelled larger by traders protecting brief positions and algorithmic merchants turning marginally extra bullish forward of the lengthy weekend. Oil futures received’t commerce on Friday, a vacation in lots of international locations, crimping volumes.

On the Center East entrance, Treasury Secretary Scott Bessent mentioned the US would apply most stress to disrupt Iran’s oil provide chain as his division sanctioned a second Chinese language refinery accused of dealing with crude from the Islamic Republic.

The so-called teapot oil processor sanctioned by the US — Shandong Shengxing Chemical Co. — had allegedly dealt with greater than $1 billion of Iranian crude, the Treasury Division mentioned. Tehran, in the meantime, warned that nuclear talks with Washington might disintegrate if the Trump administration “strikes the goalposts.”

“Whereas the macroeconomic backdrop stays combined, it has the potential to both amplify market rallies or derail them fully, relying on how these geopolitical tensions evolve,” mentioned Rebecca Babin, a senior vitality dealer at CIBC Non-public Wealth Group.

The stress of Trump’s sweeping commerce measures has put crude on the again foot this month, with costs at one level buying and selling about 30% decrease than their excessive for the yr.

This week’s rebound was aided by US authorities knowledge that confirmed stock ranges at Cushing, Oklahoma — the supply level for West Texas Intermediate — at their lowest for this time of yr since 2008. That’s serving to help close by timespreads, with WTI’s immediate unfold hitting the strongest since February on Wednesday.

Oil Costs:

- WTI for Could supply gained 3.5% to settle at $64.68 a barrel in New York.

- Brent for June settlement rose 3.2% to settle at $67.96 a barrel.

What do you suppose? We’d love to listen to from you, be part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all vitality professionals to Communicate Up about our business, share data, join with friends and business insiders and have interaction in an expert group that may empower your profession in vitality.

MORE FROM THIS AUTHOR

Bloomberg