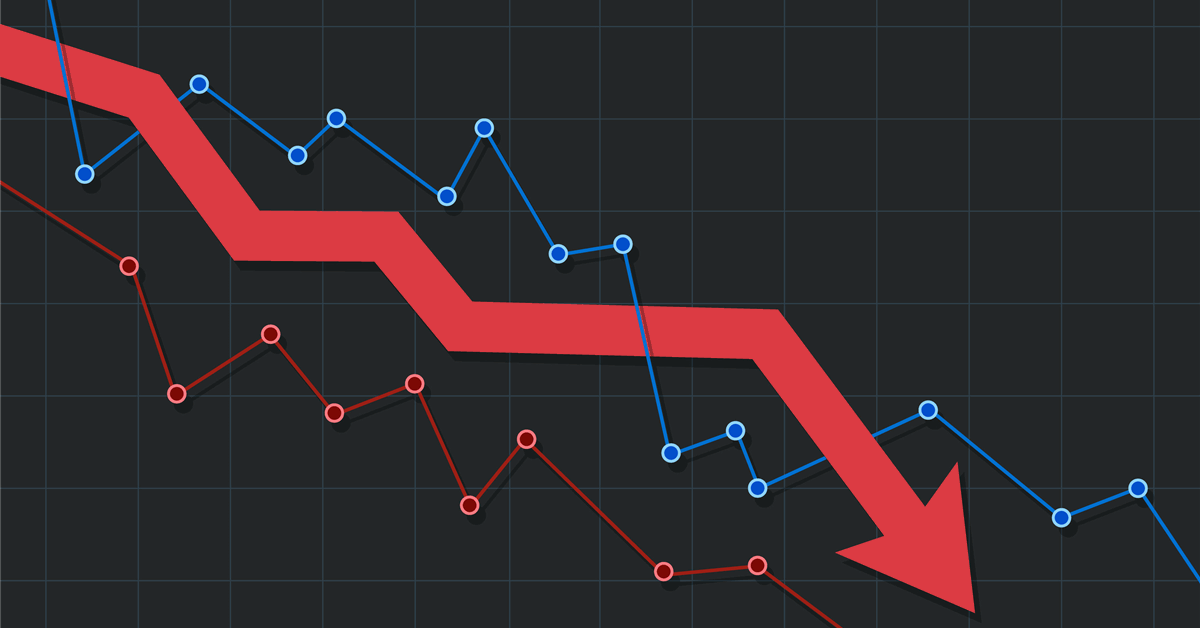

Oil slid to a six-month low as indicators of financial weak point on the planet’s two largest crude shoppers fanned issues that US tariffs will sap international vitality demand.

West Texas Intermediate dipped 1.5% to finish the session close to $66 a barrel, the bottom settlement value since September. US equities tumbled sharply on Monday and have erased all of their features since Donald Trump was elected president as his commerce actions threaten financial progress. In the meantime, China’s shopper inflation fell greater than anticipated and was under zero for the primary time in 13 months.

Crude has been hit by a confluence of bearish components, together with the escalating international commerce conflict, plans by OPEC and allies to extend manufacturing and talks to finish the three-year conflict in Ukraine. That’s spurred speculators to chop net-bullish bets on international benchmark Brent by probably the most since July, though in addition they slashed bearish wagers towards US crude.

Within the US, Trump instructed Fox Information the financial system faces a “interval of transition” after his actions on tariffs, whereas avoiding projections of a recession. On Friday, Federal Reserve Chair Jerome Powell acknowledged the rise in uncertainty, however mentioned officers didn’t must rush to chop charges.

The earlier week “delivered a yr’s value of financial turbulence,” JPMorgan Chase & Co. analysts mentioned in a word to purchasers. Regardless of some aid from a delay to tariffs towards Canada and Mexico, “the chance of ‘US excessive insurance policies’ situation has risen, triggering one of many sharpest unwinds within the crowded momentum issue.”

Carlyle Group Inc.’s Jeff Currie wrote in a analysis word Monday that the commerce in fossil fuels throughout borders peaked in 2017 and is about to say no as nations looking for vitality safety ramp up investments in renewable sources of vitality.

Over the subsequent week, merchants will get loads of market insights from the CERAWeek convention in Houston, which began Monday. Audio system on the convention’s opening day included the chief govt officers of Exxon Mobil Corp., Saudi Aramco, Chevron Corp. and Vitol Group.

Oil Costs:

- WTI for April supply dropped 1.5% to settle at $66.03 a barrel in New York.

- Brent for Could settlement slid 1.5% to settle at $69.28 a barrel.

What do you assume? We’d love to listen to from you, be a part of the dialog on the

Rigzone Power Community.

The Rigzone Power Community is a brand new social expertise created for you and all vitality professionals to Converse Up about our business, share data, join with friends and business insiders and have interaction in an expert group that may empower your profession in vitality.

MORE FROM THIS AUTHOR

Bloomberg