Lisbon-based Galp Energia SGPS S.A. has reported a substitute cost-adjusted (RCA) web revenue of EUR 71 million ($74.1 million) for the fourth quarter of 2024, 75 p.c beneath the fourth quarter of 2023.

Full-year RCA web revenue was EUR 961 million ($1 billion), 4 p.c beneath the corresponding 2023 determine.

Nevertheless, the corporate’s co-CEOs Maria João Carioca and João Diogo Marques da Silva stated it was a powerful quarter “in a 12 months of constant supply, at or above headline steering throughout all enterprise items”.

Galp posted RCA earnings earlier than curiosity, taxes, depreciation, and amortization (EBITDA) of EUR 3.3 billion ($3.4 billion) for 2024.

It ended the 12 months with EUR 1.2 billion ($1.26 billion) in web debt, down in comparison with year-end 2023.

“These outcomes not solely depict 2024 as a 12 months of sturdy execution for Galp but additionally lay the foundations for future progress and worth creation. In 2025 and 2026 we’ll proceed to execute our key progress initiatives, the hallmark of Galp’s portfolio, combining a disciplined method in direction of a low capital depth plan”, the co-CEOs stated.

Galp stated that its investments in the course of the fourth quarter reached EUR 500 million ($522.3 million), primarily channeled towards the execution of upstream initiatives, such because the Namibia appraisal marketing campaign and Bacalhau. The corporate additionally stated it continued pursuing industrial low-carbon initiatives.

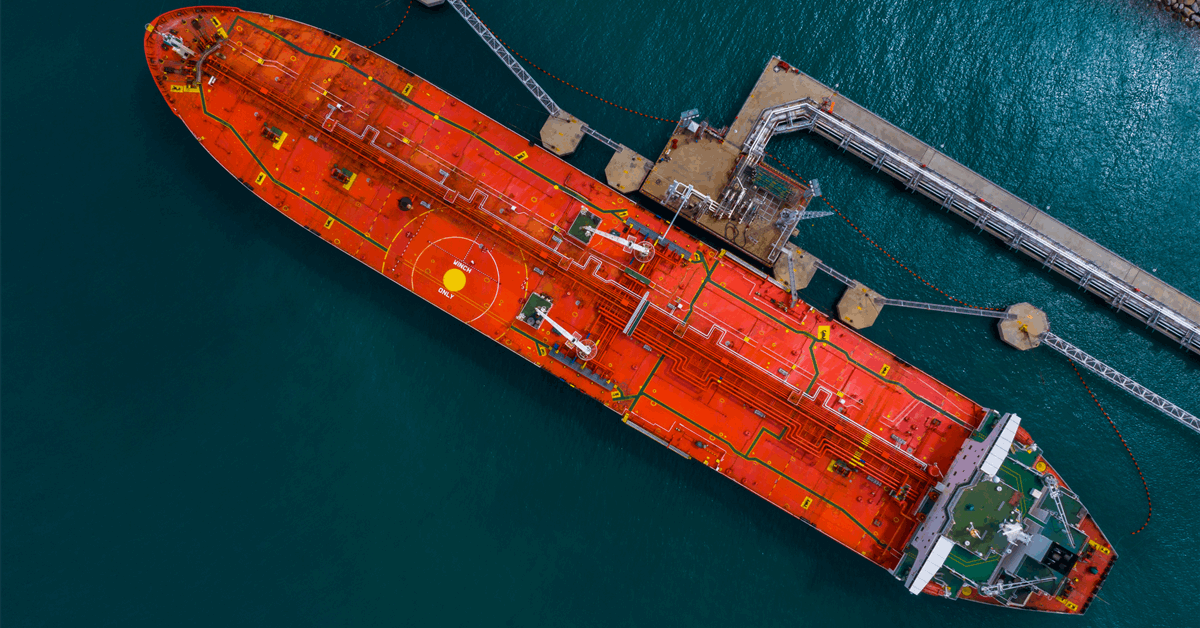

Through the quarter underneath assessment, Galp reported a year-on-year drop in manufacturing of 110,000 barrels of oil equal per day (boepd). The drop mirrored the disposal of the ten p.c stake in Space 4 in Mozambique.

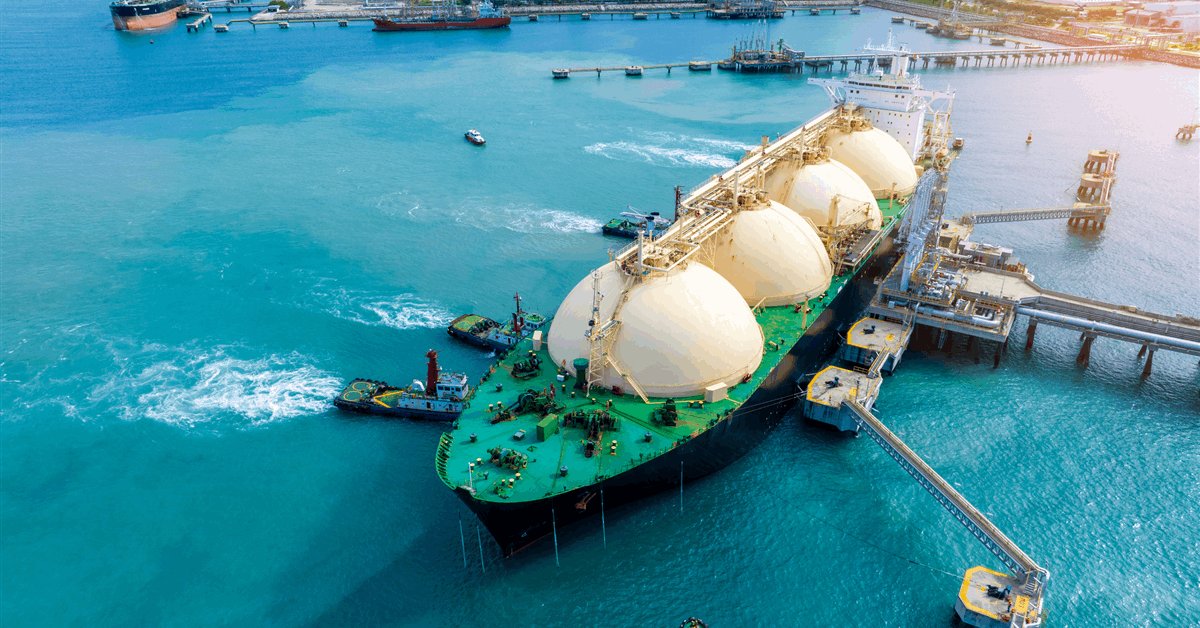

Nevertheless, Galp stated its Industrial and Midstream sectors carried out higher within the fourth quarter, with uncooked supplies processed on the Sines refinery reaching 22 million boe, considerably increased year-on-year. Provide and buying and selling volumes of pure fuel and liquefied pure fuel (LNG) reached 11.8 terawatt hours (TWh), increased year-on-year, reflecting elevated business demand, increased flexibility, and fuel sourcing alternatives in Brazil, the corporate stated.

For the complete 12 months, the corporate stated it processed 91 million boe of uncooked supplies, a document excessive, reflecting the sturdy availability and utilization of the items. Provide and buying and selling volumes of pure fuel and LNG reached 46.6 TWh, secure year-on-year.

To contact the writer, e-mail andreson.n.paul@gmail.com

What do you suppose? We’d love to listen to from you, be part of the dialog on the

Rigzone Vitality Community.

The Rigzone Vitality Community is a brand new social expertise created for you and all vitality professionals to Communicate Up about our business, share information, join with friends and business insiders and have interaction in an expert group that can empower your profession in vitality.