In a report despatched to Rigzone by the Macquarie workforce late Wednesday, Macquarie strategists revealed that they count on oil costs “to check new lows” in 2025.

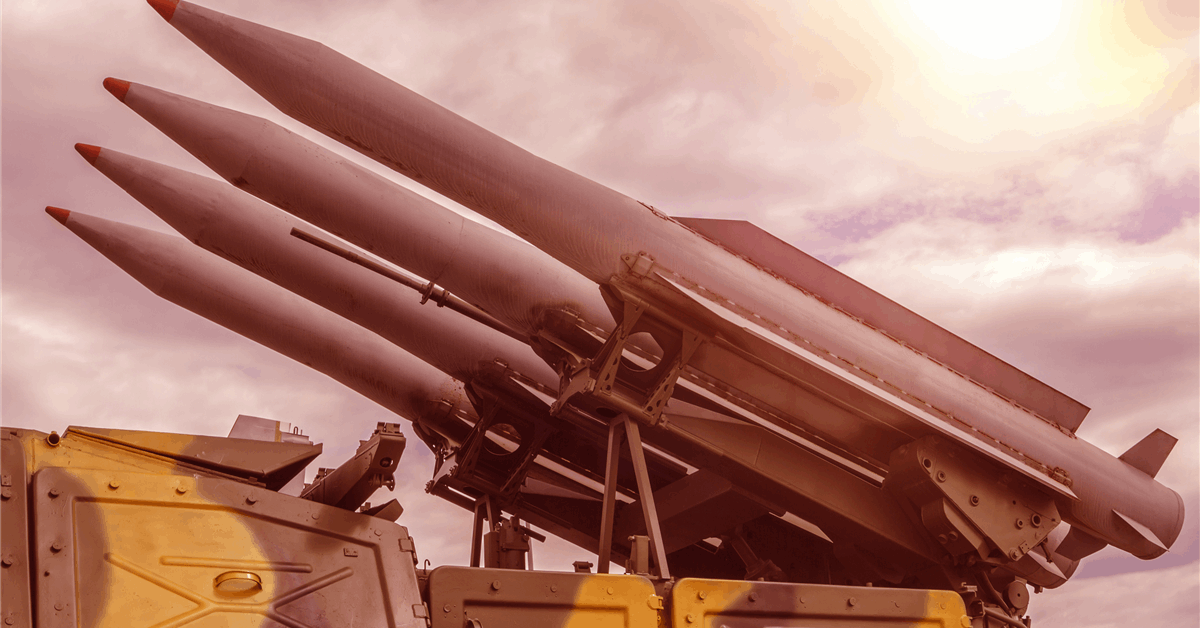

“Marginal sources of elevated provide threat because of President Trump’s re-election could embody elevated Israeli navy aggressiveness towards Iran and extra intense Ukrainian assaults in Russia, which can ultimately lead to a disruption of Russian oil exports,” Macquarie strategists said within the report.

“We view these dangers as low likelihood and could be stunned if oil provide is disrupted. In consequence, we count on oil costs to check new lows subsequent 12 months as geopolitical threat subsides and bearish elementary elements take nice weight,” they added.

Within the report, the strategists famous that, final week, Brent fell round $3 per barrel “because the Chinese language stimulus announcement disillusioned and OPEC decreased their surprisingly optimistic demand projections for the fourth consecutive month”.

“Corroborating value motion, managed cash size fell with WTI and Brent summing to a 46K lower in contract equivalents after constructing massive size the prior week,” the strategists stated.

The Macquarie strategists highlighted within the report that value has settled right into a $5 per barrel vary within the final month “because the market has struggled to interrupt out”.

“Along with an absence of non-geopolitical catalysts, the market seems to be implying that giant anticipated surplus balances in 2025 at the moment are pretty priced, pushed by weak demand of 1 million barrels per day and enormous world provide progress,” they added.

“Just like earlier weeks, geopolitical tensions have principally coated final week’s losses as Russia-Ukraine comes again into focus. Worth continues to face resistance on the 50D MA of $74,” they continued.

The strategists outlined within the report that, over the past week, WTI web size dropped by 13.4K and Brent dropped by 23.2K.

“WTI spec web size fell because the liquidation of longs overwhelmed new quick curiosity. Brent noticed an even bigger transfer with over 25 instances the addition of shorts because the lower in longs,” the strategists stated.

“Following per week of a 77.3K managed cash web size construct, this previous week demonstrated a mixed drop of 45.9K for the class as over half the earlier’ weeks transfer was reversed,” they added.

“Lastly, business members exhibited matching flows and mixed for a rise of 42.7K contracts as refiners probably look to hedge ahead margins with bearish demand catalysts outweighing bullish ones,” they went on to state.

In a market evaluation despatched to Rigzone on Wednesday, Terence Hove, Monetary Markets Strategist Advisor to Exness, famous that “crude oil futures rebounded for the third consecutive day, recovering to a sure extent from current lows”.

“The market discovered some assist in rising geopolitical considerations and indicators of elevated demand,” he added.

“The continuing escalation of the Ukraine battle may have an effect on the market as merchants assess the attainable developments. The potential disruption of Russian oil exports may gas some provide considerations,” he continued.

Hove famous within the evaluation that, “a restoration in Chinese language oil demand, with crude imports anticipated to succeed in near-record ranges by November’s finish, may contribute to a extra bullish sentiment”.

He added, nevertheless, that “Iraq’s gas oil exports are set to succeed in report ranges in 2024, pushed by elevated shipments and decreased home demand”.

“This surge may contribute in dampening the market’s prospects because the rise in oil exports may ease costs,” Hove warned.

In a separate market evaluation despatched to Rigzone on Wednesday, Samer Hasn, Senior Market Analyst at XS.com, stated “this week’s rebound in oil costs comes amid considerations that the escalating battle on the Russian-Ukrainian entrance may spiral uncontrolled, probably disrupting crude provides”.

To contact the writer, e-mail andreas.exarheas@rigzone.com