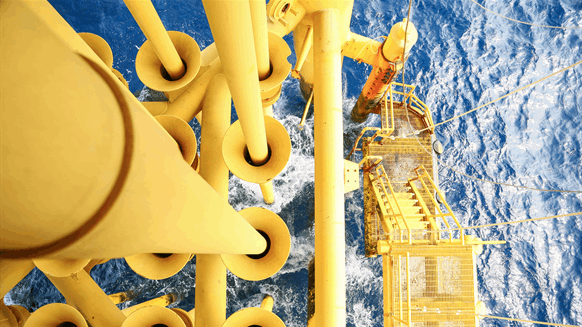

In a current interview with Rigzone, David Moseley, the Head of Europe Analysis at Welligence, supplied a world exploration roundup for 2024 from the corporate’s regional groups.

The roundup largely seems to be at offshore and covers key, oil-focused exploration areas globally, Moseley highlighted to Rigzone.

“In Sub-Saharan Africa, Mopane is the biggest discovery this 12 months,” Moseley mentioned within the interview, including that “volumes, together with the cut up of liquids to fuel, require refining by means of appraisal drilling”.

“Calao in Cote d’Ivoire is a big, unappraised discovery and is round 500 million barrels of oil equal. As well as, Enigma and Mangetti (Namibia) are materials, however each are sub-500 million barrels and likewise require appraisal,” he added.

“For the rest of the 12 months, these are those to look at – TotalEnergies’ Niamou Marine in deepwater Congo Brazzaville, ExxonMobil’s Arcturus in deepwater Namibe Basin (Angola), and Apus Vitality with Atum in deepwater Guinea Bissau,” he continued.

Taking a look at South America, Moseley mentioned the current Ultimate Funding Determination (FID) for the Sapakara and Krabdagu oil discoveries, now known as GranMorgu in Block 58, is a serious achievement and can doubtless assist speed up Suriname’s offshore exploration and appraisal efforts, notably within the neighboring Block 52, with excessive anticipation for the Fusaea-1 and Sloanea-2 wells.

“Nonetheless to return in 2024 – the Canje-1X, Trumpetfish-1, and Redmouth-1 wells scheduled for 2024 to early 2025 (Guyana). Success in these wells might doubtlessly unlock new reserves, additional solidifying Guyana’s place as a big participant within the offshore oil business,” he added.

“As well as, the upcoming Foca-1 pre-salt nicely within the Campos Basin (Brazil) is noteworthy. Success right here might contribute to Brazil’s rising pre-salt manufacturing and appeal to additional funding,” he continued.

“Nonetheless, word allowing points in Brazil’s Equatorial Margin and Colombia are affecting exploration actions, resulting in delays of wells like KOMODO-1 and Uchuva-2. These challenges spotlight the regulatory hurdles impacting the business,” Moseley warned.

Specializing in Russia/the Caspian, Moseley mentioned 5 oil discoveries have been reported, “all within the Volga Urals area, with whole volumes of circa 345 million barrels”. He highlighted that this quantity is “considerably decrease than the 43 discoveries” made final 12 months. “By way of wells to look at to year-end, these are in Kazakhstan blocks Abay (Eni & KMG), Karaton-Podsolevoy (TatNeft & KMG) & Turgai-Paleozoi (CNPC & KMG) blocks,” he added.

Trying on the Center East and North Africa, Moseley mentioned the Al-Nokhatha subject is the standout discovery, “with reserves reported at 2.1 billion barrels of oil equal”.

“As well as, Tethys (Block 58, Oman) is presently drilling (pre-drill 120 million barrel liquids) and is one to look at,” he added.

In a launch posted on its web site again in February this 12 months, Rystad Vitality mentioned oil and fuel upstream majors – specifically ExxonMobil, Shell, Chevron, BP, TotalEnergies, and Eni – “will proceed to train warning in exploration spending this 12 months, with drilling exercise poised for a busy 12 months forward”.

“In response to Rystad Vitality’s analysis, these main producers may have spent on common a mixed $7 billion every year between 2020 and 2024, a sizeable drop from the earlier four-year interval throughout which common whole spending was $10 billion,” Rystad added.

Within the launch, Rystad famous that, “regardless of tightened budgets, frontier drilling is fueling optimism for a productive 12 months, notably deepwater tasks within the Atlantic Margin, Jap Mediterranean, and Asia”.

“Final 12 months noticed a big enhance in awarded acreage to main gamers, totaling 112,000 sq. kilometers – an uptick of 20 p.c from the earlier 12 months,” the corporate mentioned within the launch.

“Notably, all awarded blocks have been offshore, with 39 p.c within the shelf section, 28 p.c in deepwater and the remaining 33 p.c in ultra-deepwater,” it added.

“The pattern suggests a big push towards deeper waters, with greater than half of the awarded blocks focusing on deepwater or ultra-deepwater reserves,” it continued.

“This focus is mirrored in world exploration exercise, with Rystad Vitality analysts predicting roughly 50 extra deepwater and ultra-deepwater exploratory wells this 12 months in comparison with 2023,” Rystad went on to state.

In a launch posted on its web site again in July, Rystad mentioned its newest analysis exhibits world recoverable oil reserves “held largely regular at round 1,500 billion barrels, down some 52 billion barrels from our 2023 evaluation”.

The corporate acknowledged within the launch that, of this year-over-year lower, 30 billion barrels are attributable to one 12 months of manufacturing and 22 billion barrels are largely attributable to downward changes of contingent sources in discoveries. Rystad highlighted within the launch that the overall recoverable oil useful resource of 1,500 billion barrels “offers an higher restrict of how a lot oil could be produced over the following 100 years or extra”.

Welligence is a market intelligence agency centered on the upstream oil and fuel sector. The corporate delivers technical information and deep evaluation for over 3,000 business upstream property, whereas masking each regional exploration block.

Rystad is a number one world unbiased analysis and vitality intelligence firm devoted to serving to shoppers navigate the way forward for vitality, the corporate states on its web site.

To contact the creator, e mail andreas.exarheas@rigzone.com